RBI Amends Master Directions for NBFC-P2P Lending Platforms to Address Regulatory Gaps

On August 16, 2024, the Reserve Bank of India (“RBI”) reviewed and amended[1] (“Amendment/Review”) the Master Direction – Non-Banking Financial Company – Peer to Peer (“P2P”) Lending Platform (Reserve Bank) Directions, 2017 (“Directions”).[2] These directions lay down guidelines concerning various functions of NBFC-P2P Lending Platforms.

The RBI observed that some platforms are bypassing regulations. For example – these platforms have been violating the prescribed funds transfer mechanism, promoting P2P lending as an investment product etc. To address these loopholes, a review has been initiated to introduce necessary modifications to the Directions.

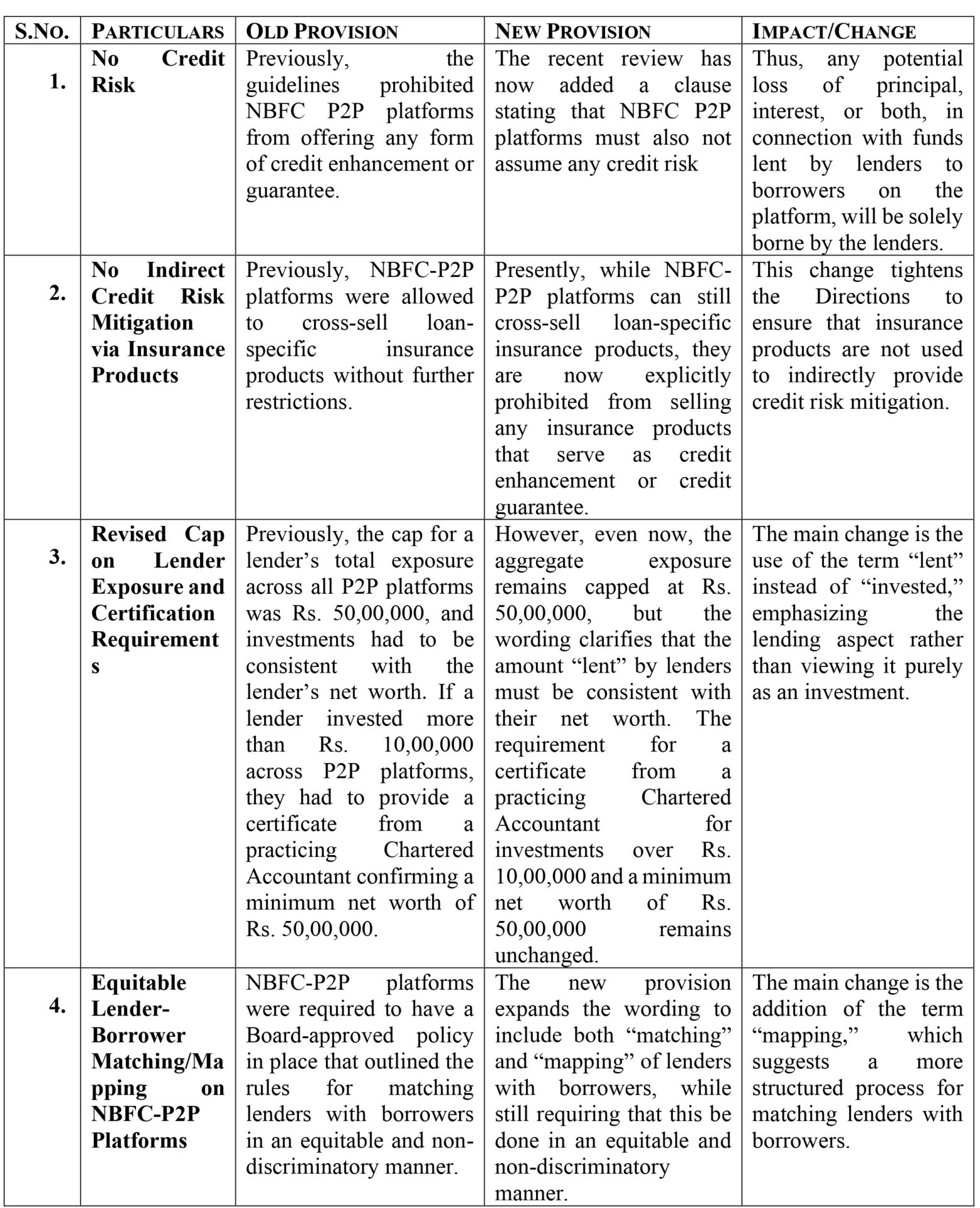

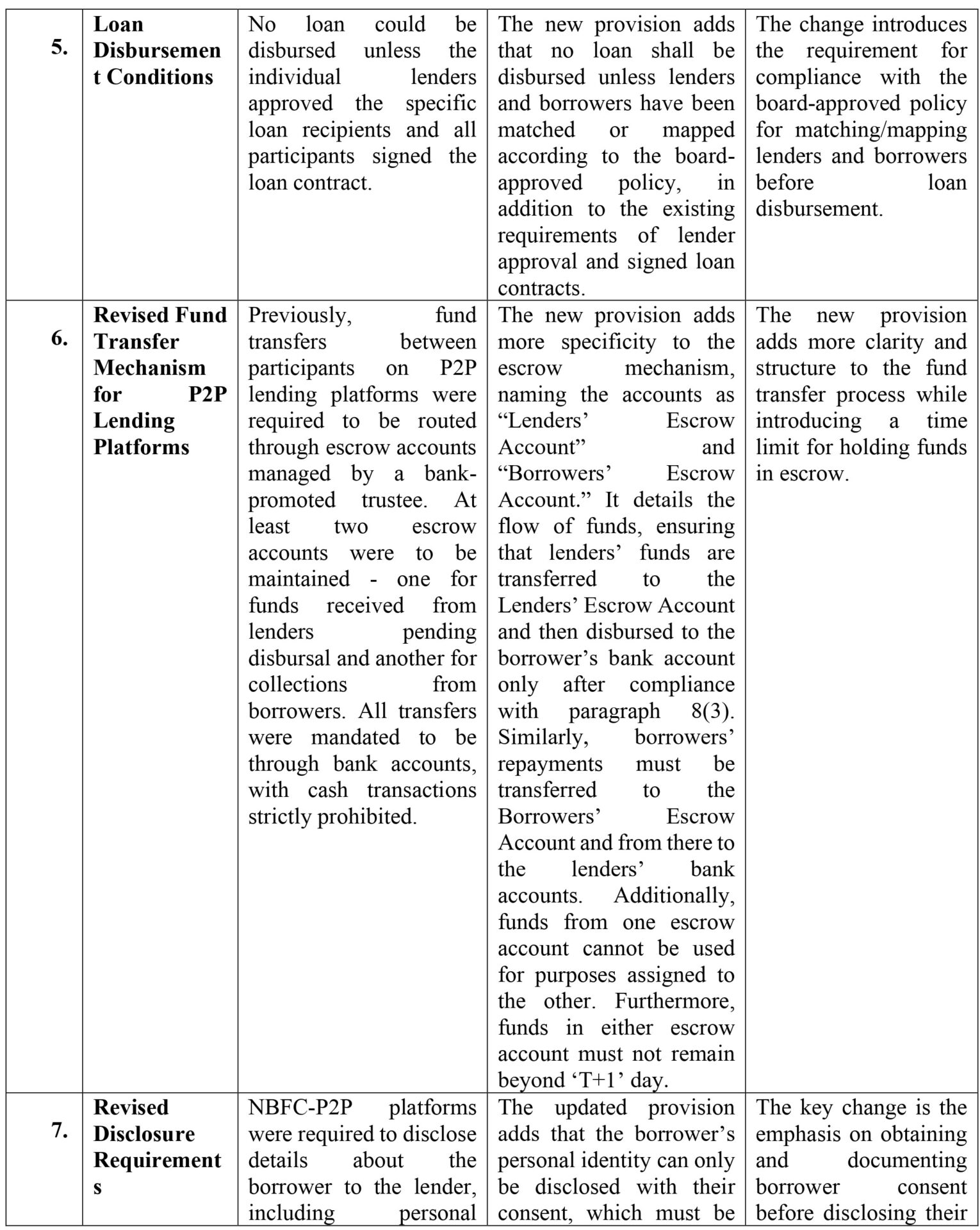

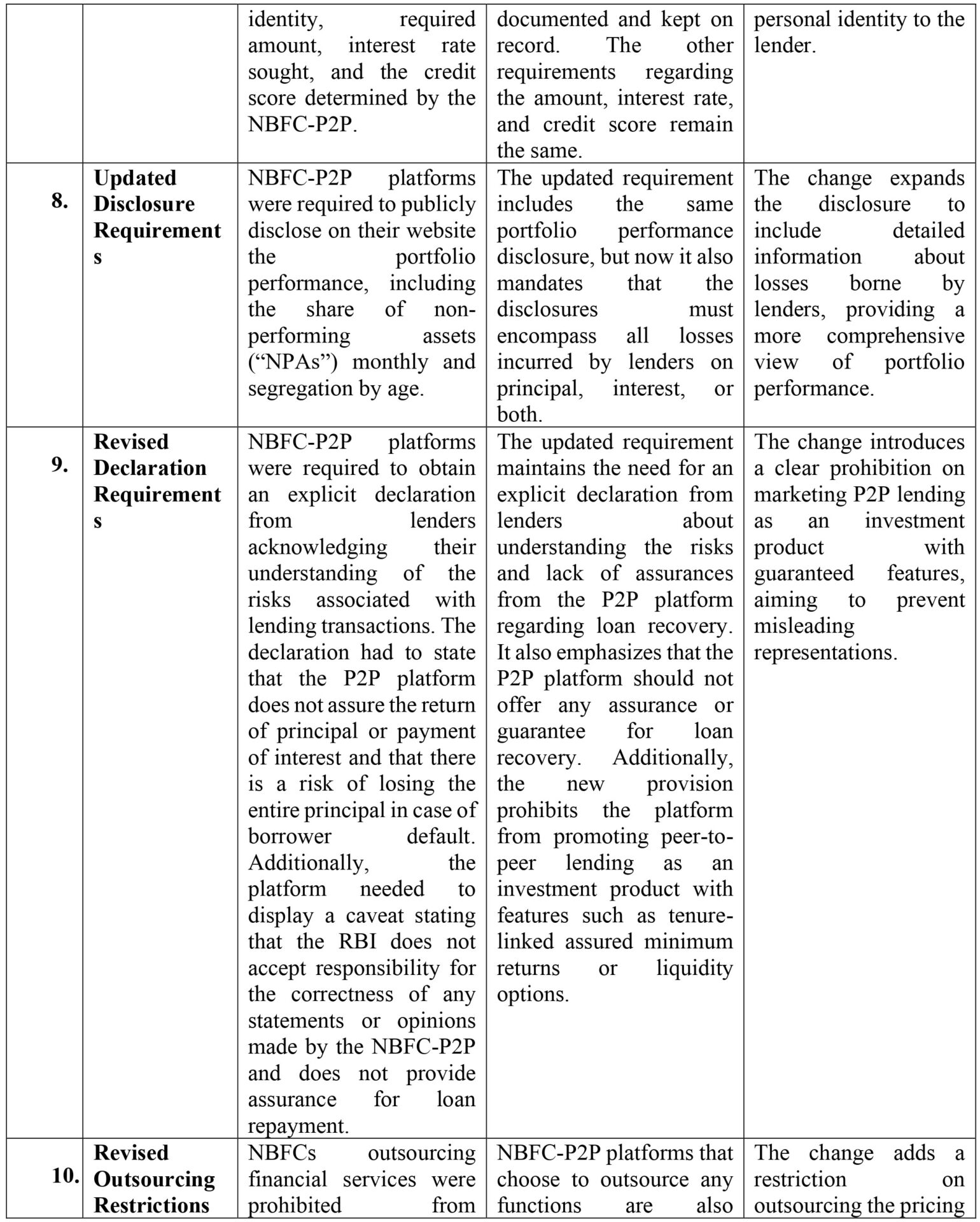

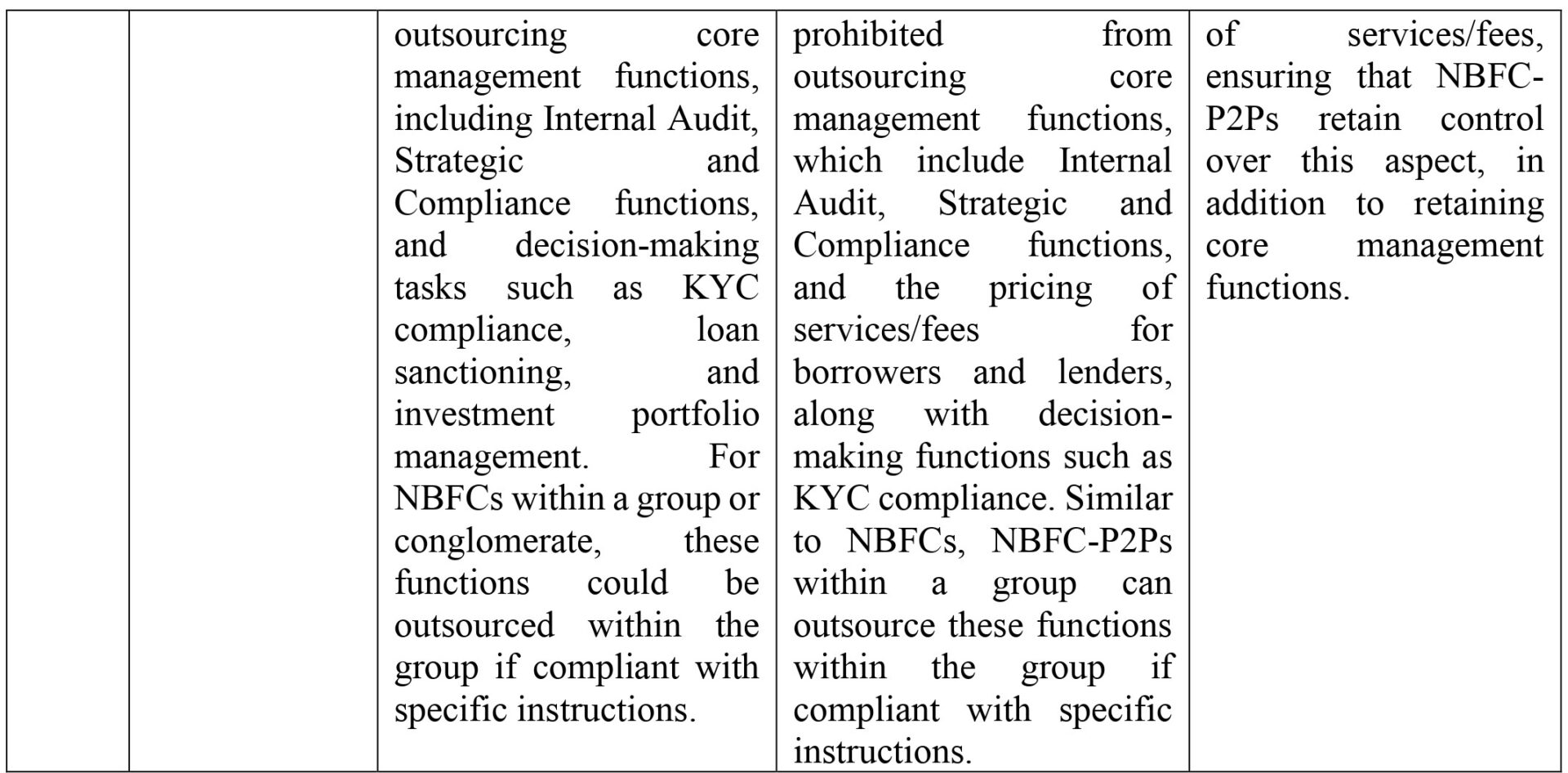

The Changes

Amendments

Additions

The review provides for the following additions in the Directions:

- NBFC-P2P platforms must only deploy lenders’ funds as specified in the Directions.

- NBFC-P2P platforms are prohibited from using a lender’s funds to replace other lenders.

- Pricing policy must be objective; fees should be disclosed upfront as a fixed amount or a fixed proportion of the principal and cannot be contingent on borrower repayment.

- Matching/mapping of participants within a ‘closed user group’ is prohibited, including those sourced through affiliates or service providers.

- NBFC-P2P platforms must prominently display their name and brand name in all customer interfaces and promotional materials.

- Platforms must include a caveat stating that while registered with the RBI, it does not take responsibility for the accuracy of statements or loan repayment assurances.

Conclusion

The RBI has tightened the norms for P2P lending platforms to boost transparency and curb misleading practices. The new rules include a ban on promoting P2P lending as an investment with guaranteed returns, stricter guidelines for fund transfers and disclosure of information, and restrictions on outsourcing essential functions. These changes aim to ensure that lenders are fully aware of the risks involved before committing their money.

[1] https://rbi.org.in/Scripts/NotificationUser.aspx?Id=12721&Mode=0.

[2] https://www.rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=11137.

By entering the email address you agree to our Privacy Policy.