SEBI Introduces Specialized Investment Funds (SIFs): A New Era In Indian Investment Management

India’s investment market is active and ever-changing. However, a gap has been noticed. Many investors, particularly those desiring more flexible portfolio management than standard mutual funds can provide but without the full commitment required for Portfolio Management Services (“PMS”), have found themselves in a sort of middle ground.

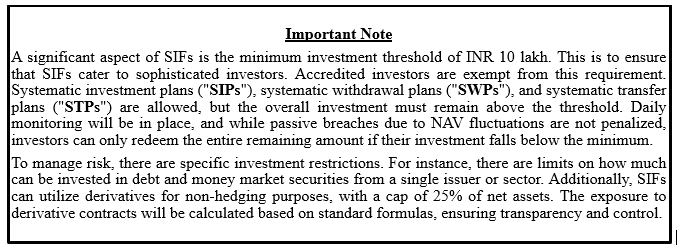

This is where SEBI’s new plan comes into play – the Specialized Investment Fund (“SIF”). SIFs, which are designed to bridge this gap, provide a new option for sophisticated investors looking for increased portfolio flexibility inside a regulated framework.[1]

Key Regulatory Changes

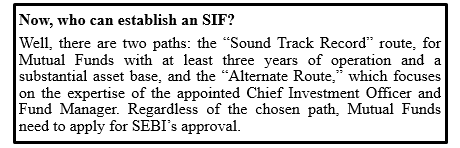

The SIF regulations will officially take effect on April 1, 2025. This gives everyone ample time to prepare. SEBI will oversee the entire process, while the Association of Mutual Funds in India (“AMFI”) will provide essential guidelines. Stock exchanges, clearing corporations, and depositories are also critical towards its implementation.

Branding is also a key consideration. SIFs will need distinct brand names and logos, separate from their parent Mutual Funds. However, to aid initial recognition, sponsors can use their brand names for the first five years, with clear disclaimers like “brought to you by.” Think of it as a new product line under a trusted brand. Also, font sizes have been regulated to ensure the SIF brand is primarily visible, and advertisement guidelines similar to mutual funds will be applied. A separate website is also required.

When it comes to investment strategies, SEBI is offering a range of options: Equity-Oriented, Debt-Oriented, and Hybrid. Each category includes specific strategies with their defined characteristics and minimum redemption frequencies, such as –

- Long-Short

- Ex-Top 100

- Sector Rotation

To maintain clarity and focus, only one investment strategy per category is permitted.

Implications

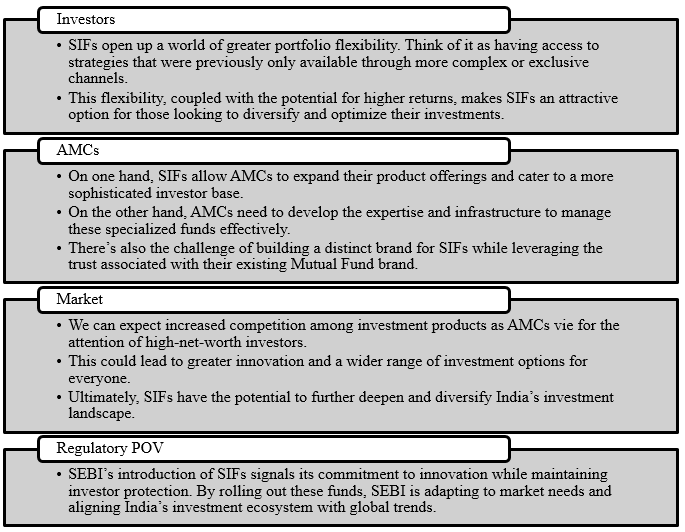

The impact can be analysed for the investors, Asset Management Companies (AMCs), Market, and Regulatory standpoint.

Conclusion

SIFs bridge the gap between Mutual Funds and PMS. They offer more tailored investment opportunities for experienced investors. SIFs provide a well-structured and regulated investment avenue due to their distinct branding, specific strategies, and minimum investment thresholds,

As awareness grows and AMCs refine their offerings, we will likely see more innovative SIFs entering the market. This will create a more competitive and dynamic environment. This would benefit both investors and the industry.

[1] https://www.sebi.gov.in/legal/circulars/feb-2025/regulatory-framework-for-specialized-investment-funds-sif-_92299.html.

By entering the email address you agree to our Privacy Policy.