Banking Transaction Tax – Viable or Unviable for India

Banking Transaction Tax was first suggested by the Arthakranti – A Pune based think-tank and was made public when the Budget process for 2018-19 was on.[1] It was to replace all the existing taxes with the exclusion of the customs with a single banking transaction tax. In this article we shall be critically analyzing the application of such in Indian tax regime, its possible implications and comparative analysis with the jurisdiction where such tax has helped replace the Income tax paradigm.

Table of Contents

Introduction:

Banking Transaction Tax (hereinafter ‘BTT’) is basically a tax that is levied on the debit and credit of the funds in the bank account of the assessee. It is also known as the Financial Transaction Tax which is levied upon different financial transactions. Its other lesser known names are Tobin Tax[2], Currency Transaction Tax, Automated Payment Tax etc. These concepts were first coined by James Tobin and John M. Keynes[3]. Hence, this concept of replacing the taxes with one single banking transaction tax is not new in Modern day economics. It has been in existence since the 1700s when philosophers like Baruch Spinoza had suggested a single tax on the land revenue which would be replacing all other forms of taxes.

In Furtherance to this philosophy, in the early 2000s, Edgar Feige[4] had proposed Automated Payment Transaction Tax which was encompassing all the transactions and by doing so would be increasing the foundation of the Income Tax[5], currently in India the Income tax is calculated on a yearly basis with deductions wherever applicable, it is calculated in the assessment year which is following year to the financial year. This allows the income to be taxed once with possible deductions, the Tax Deductible at Source (hereinafter ‘TDS’) allows the employer to deduct the tax before the salary income is transferred to the assessee, and later the assessee can claim the TDS return[6] after the tax deductions.

BTT or Automated Payment Transaction Tax does this but for all the transactions that takes place, this is also contended to be a replacement to the current Indirect tax regime which taxes the assessee for the transactions he/she makes to avail certain goods and services. Although some parts of the BTT are to be observed in the Indian Tax Regime, the whole application of the BTT can be detrimental as then the assessee would avoid availing banking services and keep the capital in cash with underground or personal deposit lockers, this would make the BTT redundant as the economy will start suffering as the CAG and Liquidity in the Banks will reduce substantially which will affect the investment of the big projects in the economy and the circulation of the money will be constrained, it will also lead to the concentration of wealth to certain classes of population and increase the income gap in the nation. This was also substantially elaborated upon in the report of the National Institute of Public Finance & Policy (NIPFP) on how the BTT is not a ‘Singularly superior tax on all its parameters’ where they were evaluating the proposal of the Arthakranti.

Critical Appraisal of BTT:

Challenges:

In India, the bank penetration is fairly less in many states, for example U.P. Has one branch per 2000 adults whereas Chhattisgarh has one branch per 3000 adults, Delhi has one branch per 8000 adults and Manipur has one branch per 33000 adults, such non uniformity of banking services can be noticed all over the nation. For this proposal to work, the population needs to be motivated to avoid paper currency and use internet banking, cheques and debit cards more. Currently, only 40% of the nation has bank accounts. In times where there are increasing cybercrimes, the security and safety of the banking systems become a challenge and will cascade into the BTT for the Government to generate full-proof revenue, as one cyber-attack can possibly cripple the economy of the nation. If this were to be implemented, the role of the ED and FIU will become vital because any hack in the transactions will lead to a loss in Government Revenue.[7]

Opportunities:

It will help simplify India’s complex tax regime, with the replacement of taxes with one single tax, it will be easy to track and harder to evade. It will change the system of transacting from cash to digital transactions which shall help in the reduction of the black money in circulation. It will inculcate healthy tax habits amongst people and increase the revenue from 10 lakhs crore to 15 lakh crores.[8]

Limitations:

It is a flat rate tax, therefore it’s regressive. As per the Supratim of FIU, “BTT has no connection with either asset value or the income levels of the person being charged”. Levying tax at the same rate for the entire population, including both rich and poor will further widen the inequality gap. BTT is assumed to replace all the taxes imposed by the Central, State and other municipal corporations in India, this revenue is proposed to be shared between the State, Centre and local authorities, each state is unique and hence has their own needs and requirements which may require varied number of taxations on the goods and services provided. Under this proposal, RBI will be responsible for the determination of the BTT which takes away the power of the state to manage its own funds. It also has a cascading effect which can make repeated transactions leading to multiple levies. Also, inter-family transactions which are under exemption, that is a father or blood relative sending money to his son, are not taxed under the current regime, will be taxable as per the BTT. Professionals like CA and Tax Lawyers[9] may be affected by these reforms as well.

Taxation has general exemptions as per our WTO norms, some products are tax free and some are highly taxed such as tobacco, that sort of differentiation is not possible when it comes to BTT with a flat rate. Its easier to evade the BTT by just moving to cash-based transactions and an alternative underground payment system or move to offshore banks. Companies may even start shifting to external purchase of raw materials to their own form of manufacturing so as to avoid the BTT, this will affect the global trade and the overall ease of doing business of India.[10]

Practical Implications:

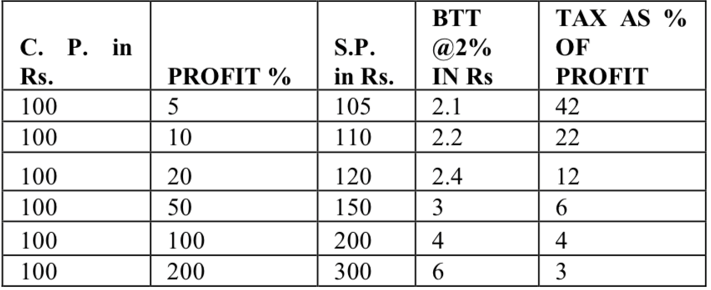

Implications of the BTT can be analyzed in tabular form in the above table, the profit margins are different on different products, the table reveals that the products that have lesser profit margins are subject to a higher tax rate as per the BTT, as compared to the products with 5% that pay tax at a rate of 42%, products with 10% margins pay 22% and that of 20% pay at 12% rate, this clearly shows how regressive this tax system could prove to be to the economy. [11]

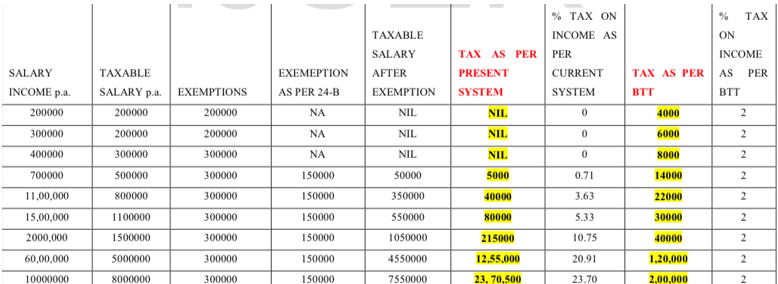

The impact on individuals can be categorized within this hypothetical salary framework. The hypothesis assumes that only income from employment is considered for tax calculations, with the assumption that the individual is availing exemptions under Section 80C and 24B of the tax law.

Under the current tax system, taxes are levied solely on the earnings and profits of manufacturing, service providers, and trading communities. These are subject to various allowances, abatements, and deductions. The analysis above highlights how the BTT (Business Turnover Tax) represents a regressive regime, wherein the tax burden on the less affluent is greater than that on the wealthier individuals. Consequently, the BTT contradicts the principle of equitable taxation.

Latin America & the Exception of Brazil:

Discussing the case of Latin America, varied governments of Latin America had at some point resorted to implementation of BTT in order to generate more revenue, as well as to tackle the effects of financial crisis and rising oil prices. It had an overall success in implementing the BTT in various forms, which is backed by the empirical data.[1]

| Country and Year | Tax Rate | Gross Revenue/GDP | Revenue Productivity |

| Brazil | |||

| 1994 | 0.25 | 0.06 | 0.24 |

| 1997 | 0.2 | 0.8 | 4 |

| 1998 | 0.2 | 0.9 | 4.5 |

| 1999 | 0.22 | 0.83 | 3.77 |

| 2000 | 0.34 | 1.33 | 3.91 |

| 2001 | 0.36 | 1.45 | 4.03 |

| Ecuador | |||

| 1999 | 1 | 3.5 | 3.50 |

| 2000 | 0.8 | 2.33 | 2.91 |

| Peru | |||

| 1990 | 1.41 | 0.59 | 0.42 |

| 1991 | 0.81 | 0.46 | 0.57 |

It was observed that the short term revenue performance of the BTT have been stronger and proves to be the foundation on the argument that the BTT can be effective in short term with low rates, it can help mitigate the financial crisis in short term and can help India in achieving its goals to mitigate the rising inflation due to the after effects of the COVID-19 Pandemic. Although from the policy standpoint the objective of BTT should be short term and the nation must eventually revert back to VAT, GST and Income Tax. One can observe how the revenues start declining after a point and hence the tax rates need to be revised periodically for the BTT to work. Brazil can be taken as the excellent example of the BTT which was because of its well-developed banking system. [2]

Conclusion & Suggestions:

In conclusion, it is evident that the Business Turnover Tax (BTT) has inherent limitations as a standalone tax and falls short on multiple fronts within the context of progressive tax systems. As highlighted in the NIPFP report, it is undoubtedly not a comprehensive solution and is not feasible as a replacement for the current tax regime. However, drawing insights from the Brazilian experience, it becomes apparent that, given well-developed banking systems and increased digital transaction volumes in India, implementing the BTT temporarily could assist in navigating through economic recovery from financial crises, especially during periods of currency devaluation. The BTT may play a stabilizing role in such circumstances, contributing to economic recovery. It is crucial to note that once the economy rebounds, the reins should be handed over to GST and the Indirect Tax regime, leading to the phased abolition of the BTT, mirroring the successful transition observed in Brazil.

[1] Cintra, M. (2010). A new tax technology: The Brazilian experience with a general bank transactions tax.

[2] Baca Campodonico, J. F., de Mello, L. R., & Kirilenko, A. A. (2006). The rates and revenue of bank transaction taxes, OECD Economics Department Working Papers, No. 494,

[1] Cintra, M. (2003). Bank transactions tax: pathway to the single tax ideal: a modern tax technology, the Brazilian experience with a bank transactions tax (1993-2007).

[2] Tobin, J. (1978). A proposal for international monetary reform. Eastern economic journal, 4(3/4), 153-159.

[3] Keynes, J. M. (2007). The General Theory of Employment, Interest and Money. Palgrave Macmillan.

[4] Feige, E. L. (2005). The Automated Payment Transaction (Apt) Tax: A Proposal to the President’s Advisory Panel on Federal Tax Reform (No. 0506011). University Library of Munich, Germany.

[5] Steiner, P. (2003). Physiocracy and French pre-classical political economy. A companion to the history of economic thought, 61.

[6] Conclusions of the European Council (10-11 December 2009), paragraph 15. (Accessed at: https://www.consilium.europa.eu/uedocs/cms_data/docs/pressdata/en/ec/111877.pdf)

[7] Suescun, R. (2004). Raising Revenue with Transaction Taxes in Latin America: Or Is It Better to Tax with the Devil You Know? Available at SSRN 610324.

[8] Coelho, I., Ebrill, L., & Summers, V. (2001). Bank Debit Taxes in Latin America-An Analysis of Recent Trends. No. 2001-2067. International Monetary Fund

[9] Western India Regional Council of The Institute of Chartered Accountants of India, 31st Regional Conference, December 10, 2016. (Accessed at: https://www.wirc-icai.org/images/material/arthakranti.pdf)

[10] Sastry, V. V. L. N. (2019). Banking Transaction Tax Unviable–Refuting the Proposition of Arthakranti. Blue Diamond Publishing.

[11] Government of India, Income Tax Department, Income Tax Return Statistics Assessment Year 2018-19, (Oct 2019), (Accessed at: https://www.incometaxindia.gov.in/Documents/Direct%20Tax%20Data/IT-Return-Statistics-Assessment-Year-2018-19.pdf)

King Stubb & Kasiva,

Advocates & Attorneys

New Delhi | Mumbai | Bangalore | Chennai | Hyderabad | Mangalore | Pune | Kochi | Kolkata

Tel: +91 11 41032969 | Email: info@ksandk.com

By entering the email address you agree to our Privacy Policy.