RBI To Regulate Foreclosure Charges On Loans For Individuals And Micro Enterprises

To improve borrower protection, the Reserve Bank of India (RBI) has released a draft circular titled “Responsible Lending Conduct – Levy of Foreclosure Charges/ Pre-payment Penalties on Loans” (Circular/Draft Circular).[1]

Table of Contents

Background

Currently, foreclosure charge regulations vary across different categories of Regulated Entities (REs), with some restrictions already in place, especially for individual borrowers on certain types of loans. However, there is a lack of consistency in how these charges are applied, often resulting in confusion and unfair treatment for borrowers. This inconsistency has led to a growing number of customer complaints and disputes.

Moreover, the RBI has found that some loan agreements contain restrictive clauses designed to discourage borrowers from switching lenders for better terms. These practices limit borrowers’ ability to secure lower interest rates or improved services.

Key Provisions

To address these concerns, the RBI is taking steps to ensure a more standardized and borrower-friendly lending framework. The Circular proposes the following changes:

| Proposal | Description |

| Individual Non-Business Loans (Floating Rate) | For individuals taking out floating rate loans for purposes other than business, there will be no foreclosure or pre-payment charges allowed. This means if you have a home loan or a personal loan with a floating interest rate, you would not be penalized for paying it off early. |

| Individual & Micro and Small Enterprises (MSEs) Business Loans (Floating Rate) | There would be no foreclosure or pre-payment charges on individuals and MSEs using floating-rate loans for business purposes. However, Tier 1 and Tier 2 Primary (Urban) Co-operative Banks and Base Layer NBFCs are excluded from this. For MSE borrowers, this exemption from charges applies up to an aggregate sanctioned limit of INR 7.50 crore per borrower.This means that if an MSE has multiple loans, the total sanctioned amount cannot exceed this limit for the rule to apply. |

| Source of Funds for Pre-payment | The source of the funds used for pre-payment does not matter. |

| Dual Rate Loans (Fixed & Floating) | In the case of such dual-rate loans, the applicable rule will be determined based on whether the loan is on a fixed or floating rate at the time of pre-payment. |

| Other Loan Types (Not Specified) | For other types of loans not specifically mentioned, lenders can charge penalties, but this must be in line with their board-approved policy. These penalties will be calculated based on the outstanding loan amount for term loans and on the sanctioned limit for cash credit or overdraft facilities. |

| Minimum Lock-in Periods | Lenders cannot impose any minimum lock-in periods.Thus, borrowers can pre-pay loans whenever they wish |

| Lender-Initiated Foreclosure/Pre-payment | If the lender initiates foreclosure or pre-payment, no charges can be levied. |

| Disclosure in Key Fact Statement (KFS) | Lenders are required to disclose whether pre-payment charges would apply in the KFS. |

| Retrospective Charges | Lenders cannot charge penalties retrospectively in case of waiver or failure to disclose them. |

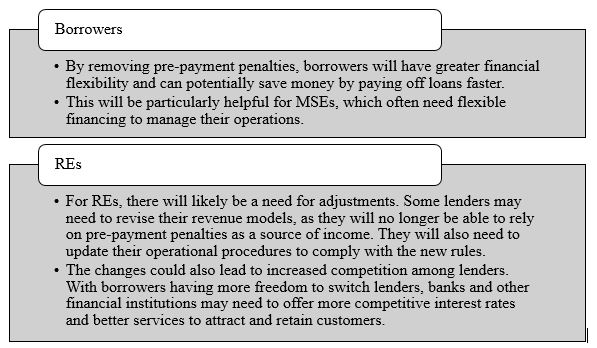

Analysis

Conclusion

In essence, the Circular proposes a significant shift in how foreclosure and pre-payment charges are handled, particularly for individual borrowers and MSEs. The RBI is attempting to eliminate these charges on floating rate loans to foster responsible lending practices and ensure a fairer financial landscape for all.

[1] https://www.rbi.org.in/scripts/bs_viewcontent.aspx?Id=4609.

King Stubb & Kasiva,

Advocates & Attorneys

New Delhi | Mumbai | Bangalore | Chennai | Hyderabad | Mangalore | Pune | Kochi

Tel: +91 11 41032969 | Email: info@ksandk.com

By entering the email address you agree to our Privacy Policy.