RBI’s Revised Framework For Monetary Penalties And Compounding Under The Payment And Settlement Systems Act, 2007

The Payment and Settlement Systems Act, 2007 (PSS Act), provides the legal framework for regulating India’s electronic payments. The Reserve Bank of India (RBI) oversees these systems to ensure their security and efficiency. To enhance enforcement, the RBI has introduced a revised framework for imposing penalties and compounding offenses under the PSS Act, promoting compliance and system integrity.

These changes align with amendments under the Jan Vishwas (Amendment of Provisions) Act, 2023, effective January 22, 2024. The new framework, effective January 30, 2025,[1] replaces the previous circular (DPSS.CO.OD.No.1328/06.08.005/2019-20)[2] and refines the RBI’s approach to handling violations. It focuses on two key mechanisms: monetary penalties for breaches and compounding certain offenses. The following sections outline the updated enforcement procedures and principles.

Table of Contents

Key Points

Offences, Penalties, and Compounding

Section 26 of the PSS Act outlines the various offenses related to payment systems. For clarity, these can be broadly categorized as follows:

| S.No. | Offense | Details |

| 1. | Unauthorized Operation | Operating a payment system without the necessary authorization from the RBI or failing to adhere to the specific terms and conditions attached to that authorization (Section 26(1)). For example, a company launching a new type of prepaid payment instrument without obtaining prior regulatory approval would fall under this category. |

| 2. | False Statements | Knowingly making false statements or omitting crucial information in applications for authorization, returns, or any other documents submitted to the RBI (Section 26(2)). This could involve misrepresenting transaction volumes or providing inaccurate details about the system’s security protocols. |

| 3. | Non-Compliance | This encompasses a range of failures, including not providing requested statements, information, returns, or documents to the RBI (Section 26(3)); disclosing prohibited information (Section 26(4)); and not complying with directions issued by the RBI or failing to pay penalties imposed by the RBI (Section 26(5)). |

| 4. | General Contraventions | Section 26(6) is a broad provision covering any contravention of the PSS Act’s provisions or any default in complying with other requirements, regulations, orders, directions, or conditions. This can include, for instance, non-compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) norms, failure to maintain required net worth, breaches of limits on Prepaid Payment Instruments (PPIs), or deficiencies in the storage of payment system data in India. For example, a payment system operator failing to conduct adequate due diligence on its customers or neglecting to implement robust cybersecurity measures could be in contravention of Section 26(6). |

Other Key Considerations

- The RBI’s authority to penalize stems from Section 30 of the PSS Act. For violations outlined in Section 26, sub-sections (2), (3), and (6), the RBI can impose fines reaching up to ₹10 lakh. If the amount involved in the transgression can be calculated, the fine can alternatively be up to double that amount, whichever is greater. Furthermore, if the violation continues, the RBI can add a daily penalty of up to ₹25,000 for each day the problem persists.

- The RBI can compound certain violations as per Section 31 of the PSS Act. This allows for a resolution without going through the full penalty process. Compounding is an option for violations described in Section 26, sub-sections (1), (3), (4), (5), and (6), with the important exception of those offenses that carry a potential prison sentence.

- Decisions about penalties and compounding are made by a designated body within the RBI. For cases handled by the Central Office, this body is a committee of three Executive Directors. At the Regional Offices, the decision-making power rests with a committee consisting of the Regional Director and two senior officers.

Procedures for Penalties and Compounding

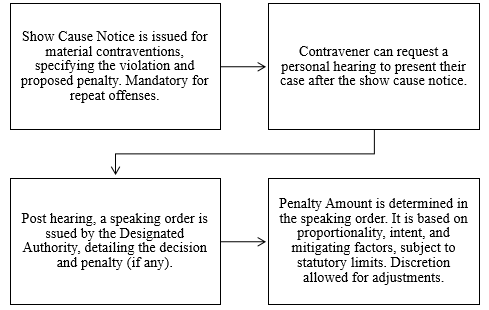

The process for imposing monetary penalties involves a structured sequence of steps:

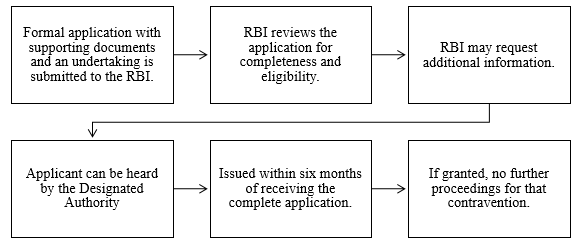

The process for compounding offenses is also well-defined:

Financial Aspects and Consequences

Compounding Amount & Payment

When figuring out the compounding amount, the starting point is the potential penalty that could be levied under Section 26 of the PSS Act. To encourage a quick resolution, there is usually a 25% reduction applied to this amount. However, if similar violations have occurred within the past five years, and those were also resolved through compounding, the amount can be bumped up by 50%, always staying within the legal limits. This increase is there to discourage repeat offenses.

Whether it’s a penalty or a compounding amount, payment is due within 30 days of receiving the order. If a penalty is not paid on time, the RBI can take further action as allowed by the PSS Act. This might involve additional fines, restrictions on how the entity operates, or even taking away their authorization altogether. If a compounding amount is not paid within the 30-day window, the compounding agreement is off the table – it’s as if it never happened. The original violation is still on the books, and legal proceedings could follow. The entity also loses the chance to apply for compounding for that specific offense again.

Conclusion

This updated framework is all about strengthening how payment systems are regulated. It aims to make enforcement more consistent and transparent. By taking into account the changes made by the Jan Vishwas (Amendment of Provisions) Act, 2023, it provides a well-defined way to handle violations. The RBI’s focus on significant breaches is meant to keep the payment ecosystem secure and running smoothly. Entities that are regulated by the PSS Act should make sure they understand these rules inside and out to avoid penalties and stay in compliance.

[1] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=12773&Mode=0.

[2] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11785&Mode=0.

King Stubb & Kasiva,

Advocates & Attorneys

New Delhi | Mumbai | Bangalore | Chennai | Hyderabad | Mangalore | Pune | Kochi

Tel: +91 11 41032969 | Email: info@ksandk.com

By entering the email address you agree to our Privacy Policy.