Compliance Checklist For Private Placement

Private placement is an effective method for companies to raise capital by directly issuing securities to a select group of investors, bypassing the public market. This approach offers several advantages, including expedited fundraising and reduced regulatory obligations. Regulatory authorities such as the Securities and Exchange Board of India (SEBI), the Reserve Bank of India (RBI), and the National Housing Bank (NHB) have established specific guidelines governing this process.

Table of Contents

Understanding Private Placement

Private placement involves issuing securities, such as shares or debentures, to a limited group of investors. Unlike public offerings, which are open to the general public, private placements target specific individuals or institutions.

To qualify as a private placement, the offer must meet specific criteria regarding the number of investors, their eligibility, and the mode of the offer. For instance, SEBI regulations limit the number of investors in a private placement to 200 per financial year. Eligible investors typically include Qualified Institutional Buyers (QIBs) or other entities meeting the stipulated criteria. The Companies Act, 2013, serves as the foundational legal framework, detailing procedures, disclosure requirements, and other obligations for raising capital through private placements.

Legal Framework

The Companies Act, 2013, is the primary legislation governing private placements in India. It outlines various provisions, including:

- Section 42: This section deals with the issuance of securities, including shares and debentures, by companies.

- Section 62: This section specifically addresses the issue of debentures.

- Section 180: This section sets limits on the amount of non-convertible debentures (NCDs) that can be issued by a company.

In addition to the Companies Act, 2013, SEBI, RBI, and NHB have issued specific regulations and guidelines for private placements.

- SEBI Regulations: SEBI has issued various regulations, such as the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018, which govern the disclosure requirements, investor protection measures, and other aspects of private placements.

- RBI Guidelines: For Non-Banking Financial Companies (NBFCs), the RBI has issued guidelines on the issuance of non-convertible debentures through private placement.

- NHB Guidelines: For Housing Finance Companies (HFCs), the National Housing Bank (NHB) has issued guidelines on the issuance of non-convertible debentures through private placement.

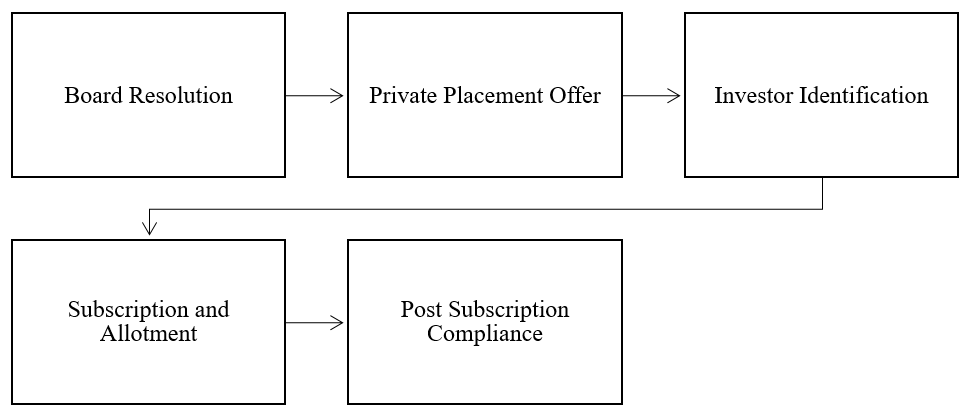

Key Compliance Steps

To facilitate a seamless and compliant private placement process, companies should adhere to the following steps:

- Board Resolution

- Pass a formal board resolution authorizing the issuance of securities through private placement.

- Ensure compliance with Section 179(3) of the Companies Act, 2013, which governs board meetings and resolutions.

- Private Placement Offer-cum-Application Letter (PPOAL)

- Prepare and circulate the PPOAL in the prescribed Form PAS-4 to potential investors.

- Include all necessary disclosures mandated by SEBI regulations, such as details about the issuer, the securities offered, terms and conditions, and risk factors.

- Ensure compliance with Rule 14 of the Companies (Prospectus and Allotment of Securities) Rules, 2014, regarding the content and format of the offer document.

- Investor Identification and Due Diligence

- Companies must conduct thorough due diligence on potential investors to ensure they meet the eligibility criteria for private placement.

- The investor’s identity and capacity to invest must be verified.

- The number of investors should not exceed the prescribed limit as per SEBI regulations.

- Subscription and Allotment

- Collect the subscription amount from investors through a designated bank account.

- Allocate securities within the stipulated timeframe after receiving the subscription amount.

- File Form PAS-3 with the Registrar of Companies within 15 days of allotment, providing details of the allotment, such as names of allottees, number of shares allotted, and amount received.

- Post-Allotment Compliance

- Share certificates must be issued to the allottees within the stipulated time.

- The company’s register of members must be updated to reflect the allotment of shares.

- Any additional compliance requirements specified by SEBI, RBI, or NHB, such as filing additional forms or disclosures, must be adhered to.

Conclusion

Private placement offers a strategic avenue for companies to raise capital efficiently while maintaining control over the investor base. However, its success hinges on strict compliance with the established legal and regulatory framework. Companies must proactively adhere to the procedural and disclosure requirements outlined by the Companies Act, SEBI, RBI, and NHB.

King Stubb & Kasiva,

Advocates & Attorneys

New Delhi | Mumbai | Bangalore | Chennai | Hyderabad | Mangalore | Pune | Kochi

Tel: +91 11 41032969 | Email: info@ksandk.com

By entering the email address you agree to our Privacy Policy.