Consultation Paper: Enhancing Transparency Through Mandatory Dematerialization Of Securities Prior To IPO

On April 30, 2025, SEBI released a Consultation paper on amendment to the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018 with the objective of mandatory de-materialization of existing securities of select shareholders prior to IPO.[1] The core objective is to introduce mandatory dematerialization of existing securities held by a broader range of shareholders before a company proceeds with an Initial Public Offering (IPO). This move is designed to further streamline and secure the capital market ecosystem.

Table of Contents

Mandatory De-materialization of Existing Securities of Select Shareholders Prior to IPO

Background

Over the past two decades, both the Securities and Exchange Board of India (SEBI) and the Ministry of Corporate Affairs (MCA) have consistently championed the dematerialization of securities. This sustained effort stems from a clear rationale: to eradicate the inherent inefficiencies and risks associated with physical share certificates. Issues such as loss, theft, forgery, and delays in transfer and settlement have historically plagued the physical mode of holding securities.

To combat these challenges, a series of progressive measures have been implemented. As early as December 13, 2000, public issues exceeding ₹10 crore were permitted only in dematerialized form. This was followed by a mandate on June 17, 2011, requiring the shareholding of promoter and promoter groups to be in dematerialized mode. By September 12, 2014, all public issues of securities were exclusively allowed in demat mode. The ICDR Regulations further reinforced this by requiring issuers undertaking an IPO to ensure promoters’ specified securities are in demat form before filing the offer document.

More recently, regulations have extended dematerialization requirements to the transfer of physical securities (April 1, 2019), allotment in rights issues (December 26, 2019), investor service requests (January 25, 2022), and bonus issues (May 23, 2023). Furthermore, unlisted public and private companies (excluding small companies) have been required to issue and hold securities in demat mode since September 10, 2018, with further amendments on October 27, 2023. Lastly, listed entities must ensure and continuously maintain 100% of their promoter(s) and promoter group shareholding in dematerialized form, as per Regulation 31(2) of SEBI LODR Regulations, 2015. Despite these comprehensive regulatory interventions, a notable volume of physical shares continues to exist, especially within unlisted entities that are preparing for listing. This perpetuates the presence of physical shares in the listed domain, adding to the overall volume of such holdings.

Need for Review

Currently, pursuant to Regulation 7(1)(c) of the ICDR Regulations, all the specified securities of the promoters must be held in a dematerialized form before the filing of the offer document. However, it has become evident that there are large expectations of physical shares even with key pre-IPO shareholders such as directors, Key Managerial Personnel (KMPs), senior management, selling shareholders, and even Qualified Institutional Buyers (QIBs), notwithstanding the aforementioned regulation and other mechanisms to facilitate the process. Accordingly, there is a regulatory gap that allows a significant number of physical shares to coexist in the market even after a company has been listed.

Rationale

The proposed amendments strongly aligneded with recent changes made by the Ministry of Corporate Affairs (MCA) through Rule 9A and Rule 9B of the Companies (Prospectus and Allotment of Securities) Rules, 2014. These MCA rules already mandate that securities be issued only in demat mode, facilitate the dematerialization of all existing securities, and require that companies can only issue or buy back securities, bonus shares, and rights if the entire holding of their promoters, directors, and KMPs is in Demat mode.

Furthermore, these rules permit subscription to privately placed, bonuses, and rights issues only if the subscriber’s existing securities are held in demat mode, and allow transfer of securities only if they are in demat form. These provisions apply to both unlisted public and private companies and all their shareholders.

In light of these existing MCA mandates, amending the ICDR Regulations to include the suggested categories of shareholders (as mentioned in paras 2.3 and 2.4 of the original consultation paper) will significantly increase the scope of dematerialization, thereby reducing the volume of physical shares in the listed space. Beyond regulatory alignment, the benefits of dematerialization are manifold. These include a substantial reduction in frauds and forgeries, the elimination of loss and damage to securities, faster and more efficient transfers, enhanced transparency, improved regulatory oversight, and the mitigation of legal disputes.

Proposal

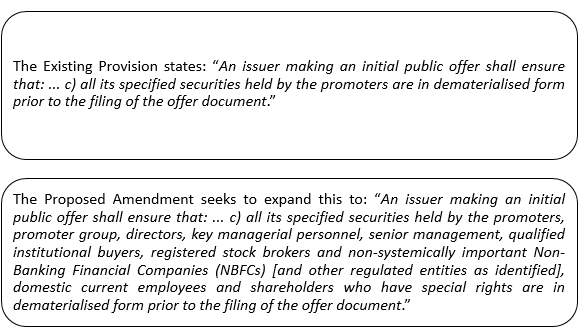

To achieve the stated objective of comprehensive dematerialization, it is formally proposed to amend regulation 7(1)(c) of the SEBI ICDR Regulations.

This proposed change is a crucial step towards creating a more secure, transparent, and efficient securities market in India.

Conclusion

SEBI’s proposal to revise the ICDR Regulations is the beginning of a new era in India’s securities market, which is transitioning to a digitized and efficient ecosystem. SEBI’s decision to expand the base of mandatory dematerialization to include more pre-IPO shareholders will help to reduce some of the festering inefficiencies and risks of physical shareholding that have so far inhibited public companies and early investors from fluid participation in the equity markets. This a positive step that integrates with other regulatory frameworks, while adding to overall transparency in the market, and ultimately reduces fraud, and risk and irrevocably establishes a shareholder transaction record in a digital format that does not confuse. This increased measure of confidence giving and security may lead to increased participation by all stakeholders.

[1] https://www.sebi.gov.in/reports-and-statistics/reports/apr-2025/consultation-paper-on-amendment-to-securities-and-exchange-board-of-india-issue-of-capital-and-disclosure-requirements-regulations-2018-with-the-objective-of-mandatory-de-materialization-of-existin-_93728.html.

King Stubb & Kasiva,

Advocates & Attorneys

New Delhi | Mumbai | Bangalore | Chennai | Hyderabad | Mangalore | Pune | Kochi

Tel: +91 11 41032969 | Email: info@ksandk.com

By entering the email address you agree to our Privacy Policy.