SEBI Consultation Paper On Treatment Of Unclaimed Funds And Securities

On February 11, 2025, the Securities and Exchange Board of India (SEBI) released a consultation paper on “Treatment of unclaimed funds and securities of clients lying with Trading Members.”[1] The objective of the same is to protect the interest of investors, a mechanism to be introduced for the treatment of unclaimed funds and securities of investors lying with the Trading Members (TM).

Table of Contents

Key Proposals

Definition of Unclaimed funds and securities

The Consultation Paper defines “Unclaimed funds and securities.” Accordingly, “unclaimed funds” refer to client monies that TMs cannot return due to reasons like incorrect bank details, while “unclaimed securities” are securities that TMs cannot deliver due to issues like inactive demat accounts.

Management of Unclaimed Funds

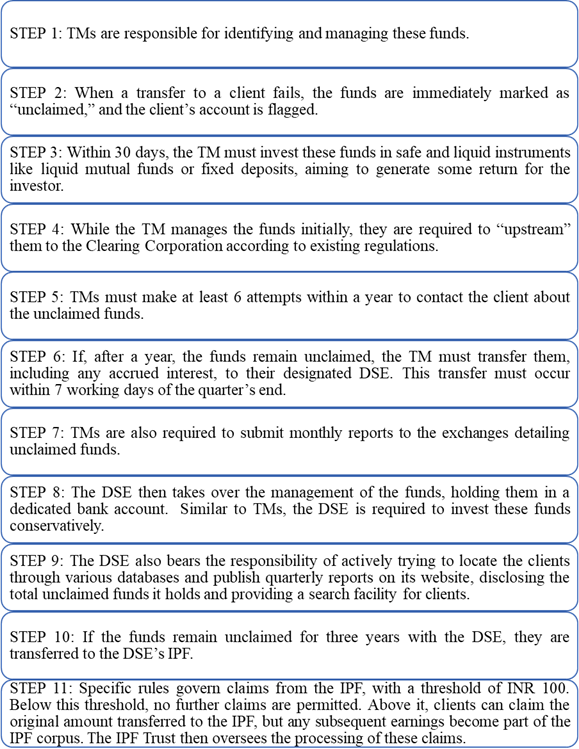

The proposed guidelines outline a multi-stage process for managing unclaimed funds. This involves the following:

Management of Unclaimed Securities

The handling of unclaimed securities follows a similar, though not identical, process.

- Securities that cannot be delivered are marked as “unclaimed.”

- After 7 days, the TM must pledge these securities to the DSE’s dedicated demat account.

- Strict restrictions are placed on altering the client’s Unique Client Code (UCC) once securities are pledged.

- Corporate action benefits on pledged securities are credited to the client’s ledger and transferred to the DSE quarterly.

- TMs also submit quarterly reports on unclaimed securities to the DSE, who then shares this information with the clients.

Claiming What’s Yours: The Process for the Clients

The guidelines also detail the process for clients to reclaim their funds or securities.

- If a claim is made before the transfer to the DSE, the TM is responsible for verifying and settling it within 5 working days.

- After the transfer, the TM assists the client in making a claim with the DSE. The DSE then processes these claims, aiming for a five-day turnaround.

- In cases of TM default, clients can file claims directly with the DSE.

- No fees are charged for maintaining unclaimed assets, and payouts are subject to applicable taxes.

Oversight and Monitoring

- The DSE’s Regulatory Oversight Committee (ROC) plays a crucial role in monitoring the implementation of these guidelines.

- The DSE is required to submit half-yearly reports to SEBI and its governing board, ensuring transparency and accountability.

Final Words

By establishing clear procedures and responsibilities for handling unclaimed funds and securities, SEBI aims to foster greater confidence in the market and ensure that investors can ultimately access what rightfully belongs to them.

[1] https://www.sebi.gov.in/reports-and-statistics/reports/feb-2025/consultation-paper-on-treatment-of-unclaimed-funds-and-securities-of-clients-lying-with-trading-members_91811.html.

King Stubb & Kasiva,

Advocates & Attorneys

New Delhi | Mumbai | Bangalore | Chennai | Hyderabad | Mangalore | Pune | Kochi

Tel: +91 11 41032969 | Email: info@ksandk.com

By entering the email address you agree to our Privacy Policy.