SEBI’s Consultation Paper on Draft Circular for Reporting by Foreign Venture Capital Investors

The Securities and Exchange Board of India (“SEBI”) is set to overhaul the reporting requirements for Foreign Venture Capital Investors (“FVCIs”). It released a public consultation paper on August 8, 2024.[1] The proposed changes aim to streamline the reporting process and provide regulators with more comprehensive data on foreign investments in Indian startups.

Foreign Venture Capital Investors (FVCIs) are entities based outside India that invest in Indian companies. To regulate their activities and gather essential market data, SEBI mandates that FVCIs submit quarterly reports detailing their venture capital investments. Under Regulation 13(1) of the Foreign Venture Capital Investors Regulations, 2000, FVCIs are obligated to provide SEBI with quarterly reports outlining their venture capital activities. The format for these reports was previously specified in a SEBI circular dated January 12, 2010.[2]

Table of Contents

Key Points of the Draft Circular

Given the evolving landscape of the securities market and the upcoming amendments to the Foreign Venture Capital Investors Regulations, SEBI has deemed it necessary to revise the reporting format for Foreign Venture Capital Investors (FVCIs). The revised format aims to gather more relevant and up-to-date information to facilitate effective market oversight. The key highlights are as follows:

- Revised Reporting Format: The updated format outlines detailed requirements for FVCIs to report their venture capital activities in India. This includes specific information on investments, fund management, and compliance with SEBI regulations. The format is structured to capture both equity and debt investments, as well as investments in listed and unlisted companies, among other categories.

- Online Submission Requirement: FVCIs are required to submit their quarterly reports exclusively through the SEBI intermediary portal (SI Portal). This online submission must be completed within 15 calendar days from the end of each quarter. The streamlined digital process is intended to facilitate timely and accurate reporting, ensuring that SEBI has up-to-date information on Foreign Venture Capital Investors (FVCI) activities.

- Custodian Responsibility: Under Regulation 14(2) of the SEBI (Foreign Venture Capital Investors) Regulations, 2000, the domestic custodians associated with FVCIs are responsible for ensuring the timely submission of these quarterly reports. This responsibility emphasizes the role of custodians in maintaining compliance with SEBI’s reporting requirements and supporting the FVCIs in adhering to the regulatory framework.

Applicability

- The first report that must be submitted in the revised format is for the quarter ending September 30, 2024. Foreign Venture Capital Investors (FVCIs) are required to submit this report by November 15, 2024. This deadline allows FVCIs and their custodians sufficient time to adapt to the proposed reporting format and ensures that SEBI receives accurate data.

- Starting with the quarter ending December 31, 2024, all FVCIs must use the revised format for their quarterly reports. This ongoing requirement solidifies the revised format as the standard for reporting, making it a critical aspect of FVCI compliance with SEBI regulations.

Revised Format

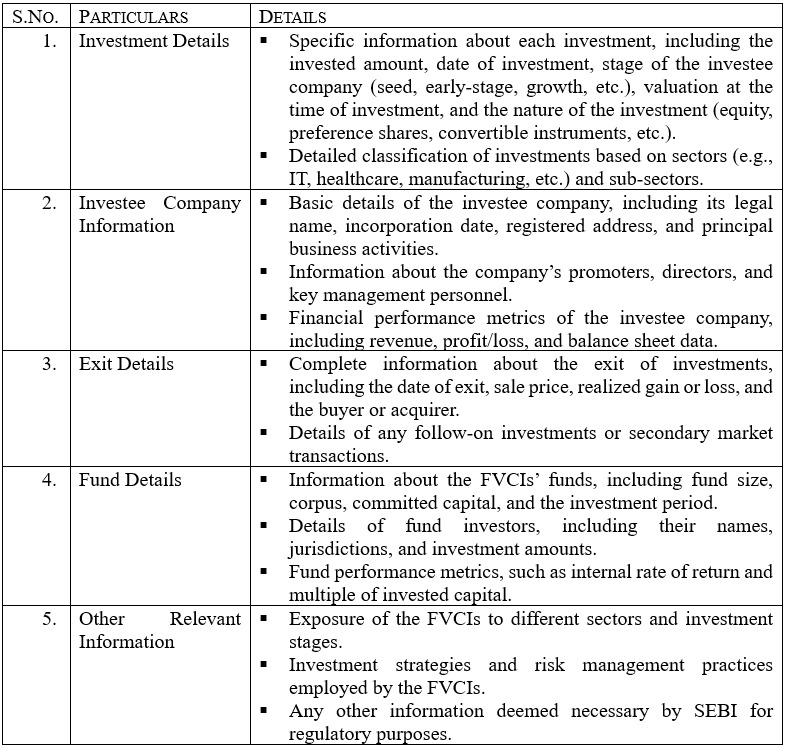

The annexure is expected to encompass a wide range of data points, including but not limited to:

Conclusion

SEBI’s proposed reporting requirements for Foreign Venture Capital Investors (FVCIs) mark a pivotal move towards greater transparency and regulatory efficiency in India’s venture capital scene. The revised format and mandatory online submissions are designed to provide SEBI with more detailed insights into foreign investments in Indian startups, helping to better monitor and guide market activities. By holding domestic custodians responsible for timely report submissions, SEBI ensures a smooth transition to this new standard, which becomes mandatory from the December 2024 quarter onward. These changes will streamline the reporting process and support a more transparent and well-regulated investment environment in India.

[1] https://www.sebi.gov.in/reports-and-statistics/reports/aug-2024/consultation-paper-on-draft-circular-for-reporting-by-foreign-venture-capital-investors_85551.html.

[2] https://www.sebi.gov.in/legal/circulars/jan-2010/revised-quarterly-reporting-format-for-venture-capital-funds_2645.html.

King Stubb & Kasiva,

Advocates & Attorneys

New Delhi | Mumbai | Bangalore | Chennai | Hyderabad | Mangalore | Pune | Kochi

Tel: +91 11 41032969 | Email: info@ksandk.com

By entering the email address you agree to our Privacy Policy.