Licensing Landscape for Online Gaming in India

The Indian online gaming industry is on a remarkable growth trajectory, driven by rising digital penetration, evolving consumer preferences, and significant investments. However, operating in this domain requires a nuanced understanding of the regulatory framework, which is shaped by diverse state-specific laws and guidelines. This article provides a detailed explanation of the licensing landscape for online gaming operators in India with reference to key requirements, restrictions, and compliance obligations.

Table of Contents

Licensing and Regulatory Framework

India’s regulatory framework for online gaming is a “patchwork of state-level laws,” often differing in scope and stringency. While gambling is prohibited in many states, exceptions for games of skill have led to a dynamic yet complex regulatory environment.

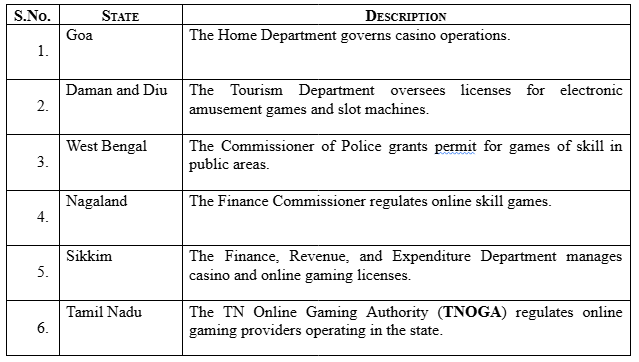

Regulatory Authorities

Key licensing authorities and their jurisdictions include:

Regulatory Approach

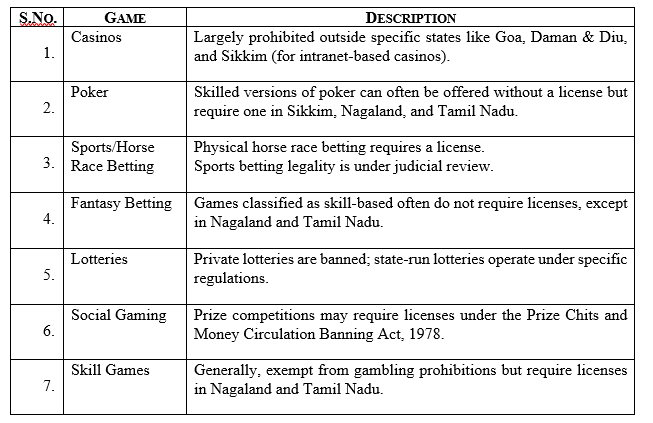

State gaming laws generally prohibit betting and wagering involving stakes, classifying them as gambling. However, most states provide exemptions for games of skill, emphasizing the importance of determining whether a game qualifies as skill-based to ensure compliance.

Types of Licenses

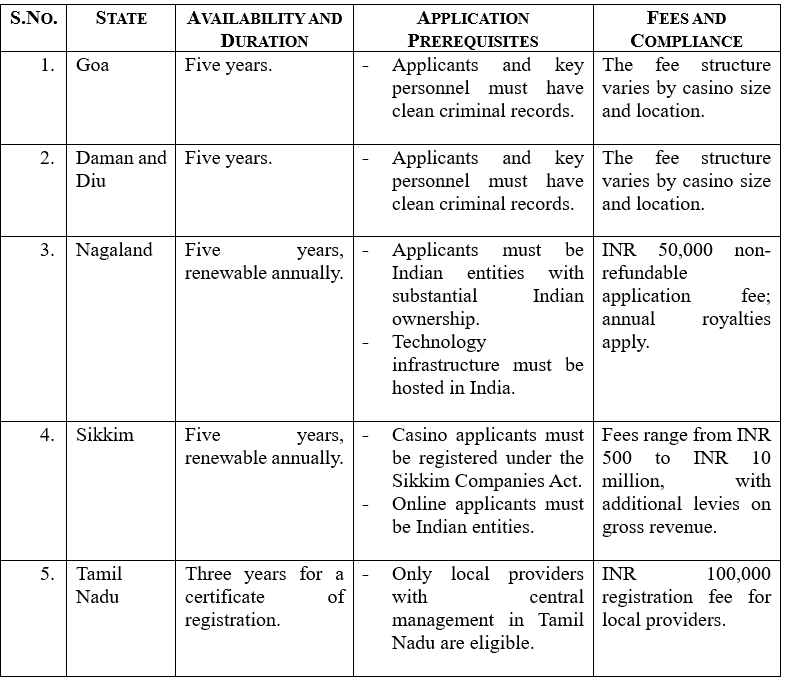

Licensing Requirements

Availability and Duration of Licenses

Advertising and Service Restrictions

India imposes stringent restrictions on advertising gaming services to protect consumers and uphold public welfare.

Key Prohibitions

Most state laws prohibit advertisements facilitating gambling, especially for games of chance. For instance, Tamil Nadu has imposed a total ban on advertisements for online gambling.

Other laws such as the Consumer Protection Act and Misleading Advertisement Guidelines 2022 enforce strict penalties for deceptive promotions. The ASCI Guidelines also provide that real-money gaming advertisements must avoid targeting minors and include disclaimers about financial risks and addiction. Furthermore, organizations like the All India Gaming Federation (AIGF) and the Federation of Indian Fantasy Sports (FIFS) impose voluntary standards for advertising transparency, player protection, and responsible gaming.

Taxation and Social Responsibility

Winnings from online games are subject to a 30% income tax with mandatory withholding obligations. From a GST perspective, 28% is levied on entry deposits for real-money games, while 18% applies to service fees charged by online gaming platforms. While most state laws lack formal social responsibility requirements, industry associations have developed voluntary guidelines, encompassing age-gating, self-exclusion mechanisms, and transparency in gaming rules to promote responsible gaming practices.

Conclusion

India’s online gaming sector presents immense potential but requires navigating a labyrinthine regulatory framework. Understanding state-specific laws, maintaining compliance with licensing requirements, and adhering to tax, advertising, and social responsibility obligations are critical for operators aiming to thrive in this dynamic market. Proactive engagement with legal and industry developments will enable stakeholders to seize opportunities while mitigating risks in this burgeoning sector.

King Stubb & Kasiva,

Advocates & Attorneys

New Delhi | Mumbai | Bangalore | Chennai | Hyderabad | Mangalore | Pune | Kochi

Tel: +91 11 41032969 | Email: info@ksandk.com

By entering the email address you agree to our Privacy Policy.