Investing in AIFs in Gift City: What You Need to Know

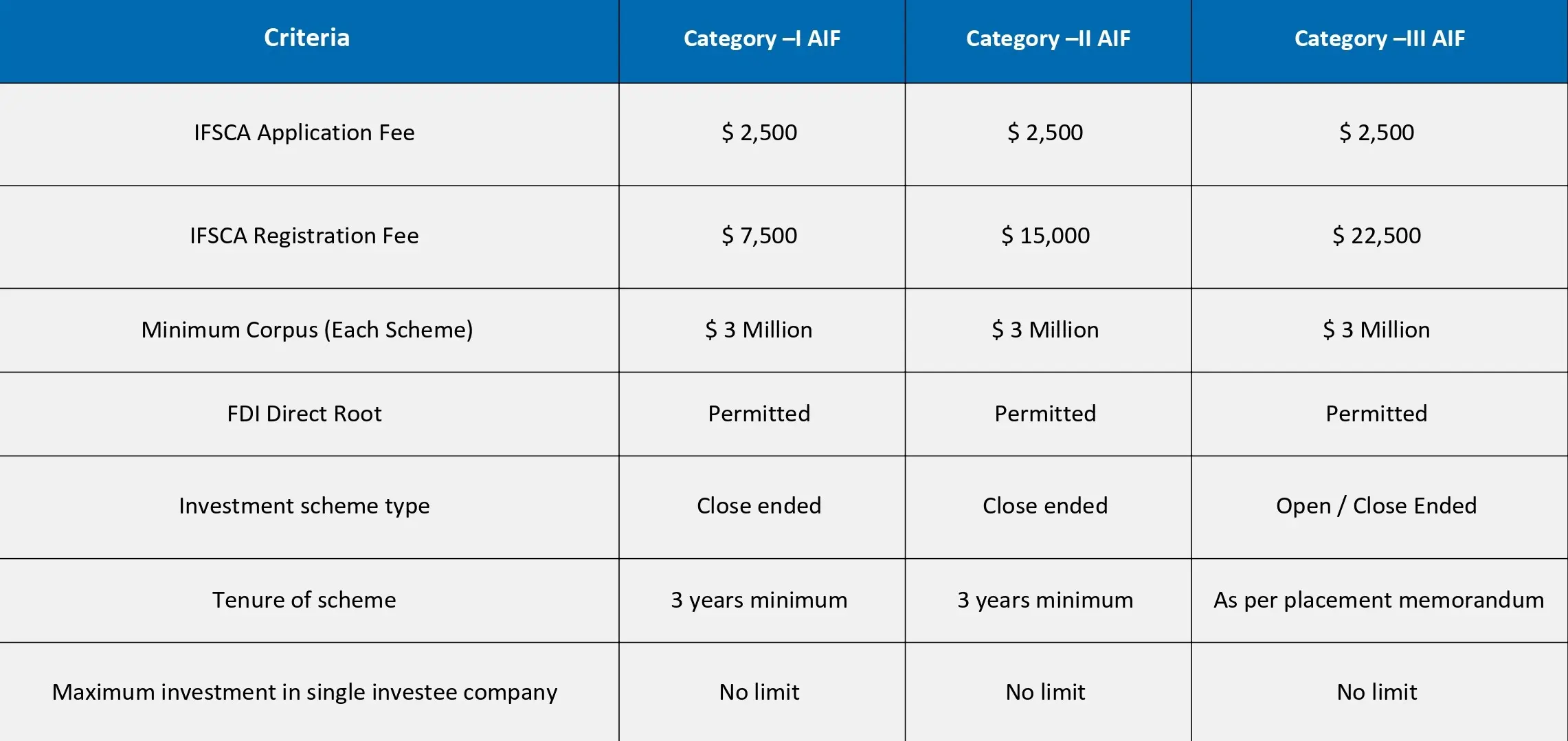

Criteria for AIFs in IFSC

AIF in IFSC

Regulatory framework

Fund/Investors

- Any entity registered with SEBI or registered or recognized with

- a regulator of a foreign jurisdiction may set up an AIF in IFSC Regulatory approval needed from SEBI / IFSCA

- The Fund can be set up as a trust or partnership or firm

- Investors:

- Non-residents Including NRIs ‒Domestic institutional

- Investors eligible under FEMA to invest offshore and

- Resident individuals with a net worth of at least USD 1 million

Sponsor/Manager

- Either the sponsor or Manager of AIF needs to be in IFSC. The sponsor/manager entity can be:

- Newly set up company or LLP in IFSC; or

- Branch of existing AIF sponsor/manager

- Sponsor commitment:

- Category I & II: Lower of 2.5% of corpus or USD 750,000

- Category III: Lower of Lower of 5% of corpus or USD 1.5 mn

Contribution/investment

- Minimum contribution:

- From an Investor: Not less than 150,000 USD

- From employees or Directors: 40,000 USD

- Investment restrictions:

- Category I and II: Maximum 25% of the investible funds in one investee company

- Category III AIF: Maximum 10% of its investible funds in one investee company

- Permitted securities:

- Securities listed in IFSC

- Securities issued by Indian cos. or cos. In IFSC or foreign cos.

- Units of an AIF

Key conditions

- Leverage

- Category I and II –Not allowed except for meeting temporary fund requirements (i) not exceeding 30 days (ii) not more than 4 occasions in a year and (iii) not more than 10% of the investable funds

- Category III –allowed subject to a maximum limit of 2 times the NAV of the fund

- Need to appoint custodian:

- Category I and II: Mandatory to appoint a custodian if the corpus of AIF exceeds USD 70 million

- Category III: Mandatory appointment of custodian

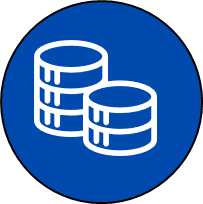

AIF Categories in IFSC

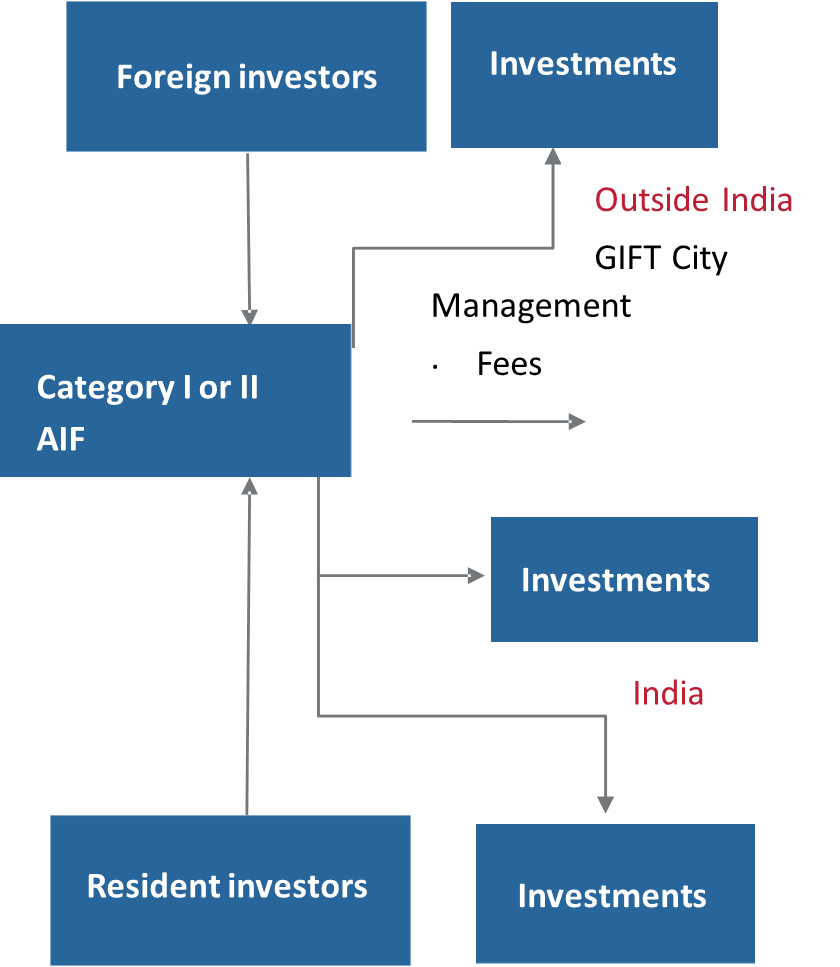

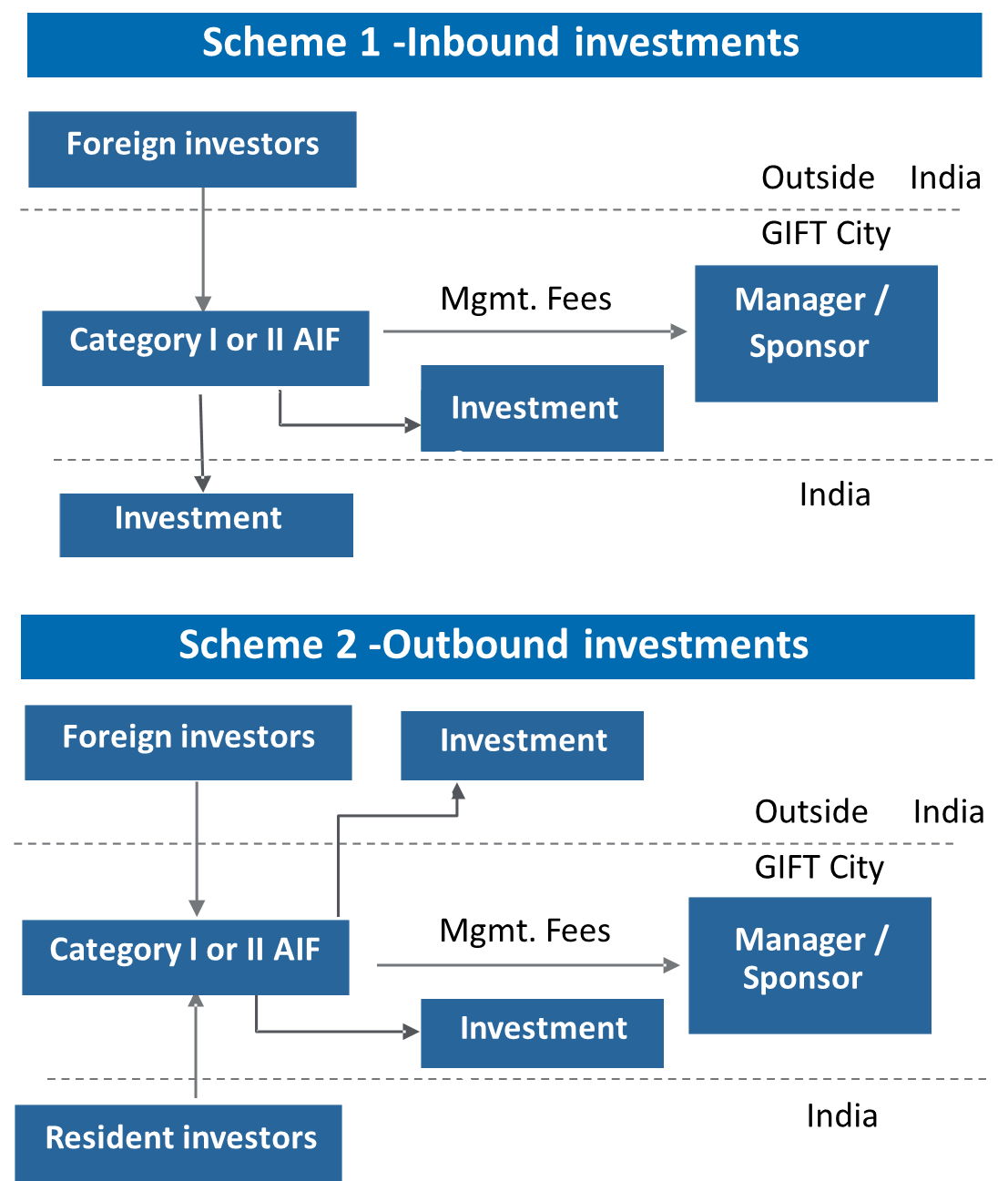

Structure 1: Category I & II AIF in IFSC

Inbound and outbound investments

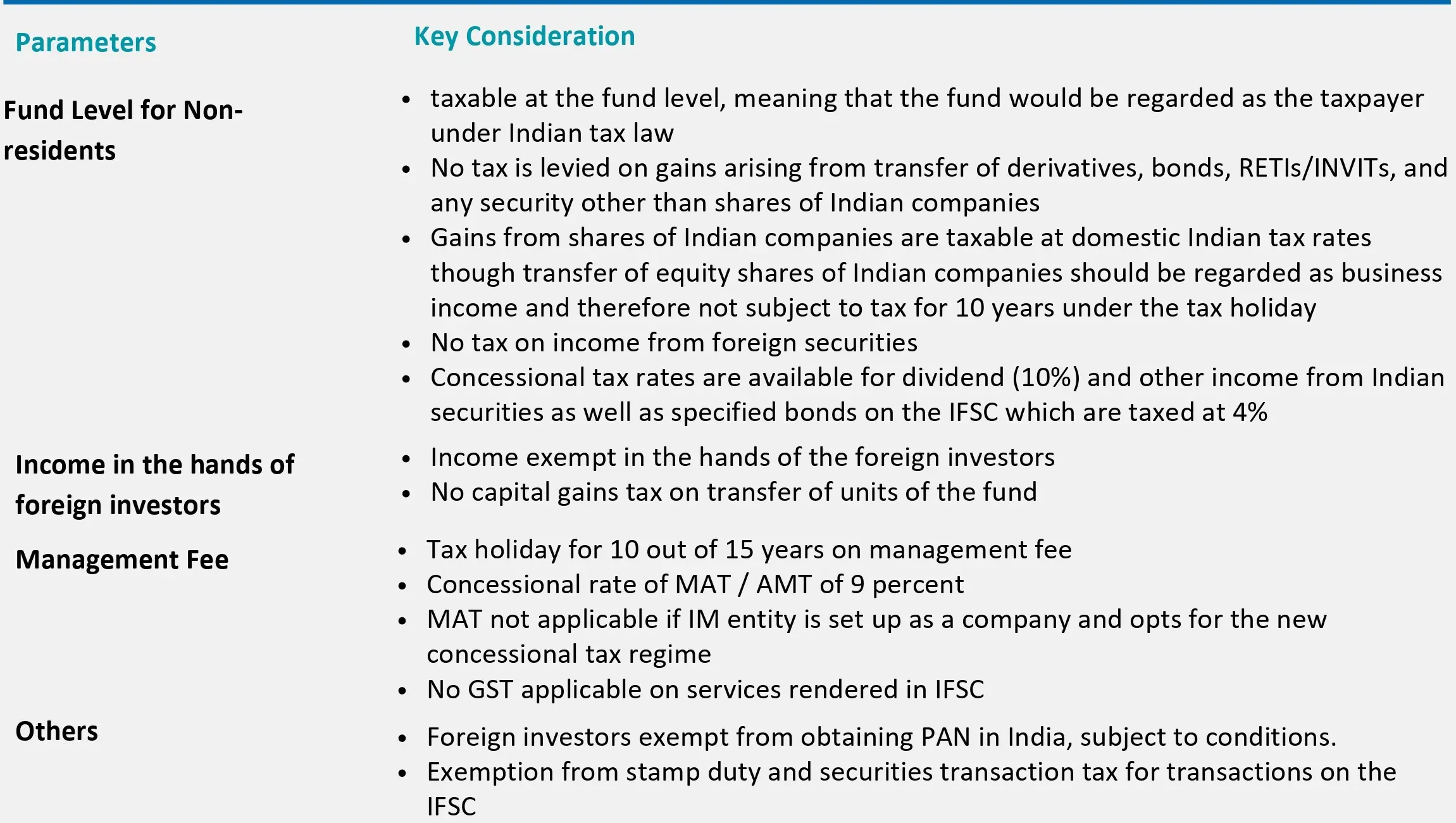

Tax Benefits for Cat I II AIFs

Pass Through – Category I and Category II AIFs have tax pass-through status for Indian income-tax purposes.

Business income – Raxable in the hands of the AIF for which 100% tax holiday can be claimed for a period of 10 consecutive years out of a block of first 15 years.

Management fees – No tax on Management fees and also not subject to MAT –beneficial for managerial fee income and carried interest.

No GST applicable on services rendered in IFSC.

No capital gains tax in the hands of foreign investors – On transfer of any bond, foreign currency denominated equity share, GDR, derivative, units of mutual fund, AIF on IFSCstock exchange.

Concessional tax rate – 4% tax rate on interest for IFSC exchange listed bond.

Overseas investment– No restriction on investment in the security of foreign co. (no condition of India connection and no SEBI approval required).

PAN and Tax Return – Foreign investors exempt from obtaining PAN and filing Tax Returns.

Other aspects – All other aspects on inbound investment remain same as compared to domestic AIF.

Notes:-

Tax exemption – for AIF’s registered elsewhere in India, business income is taxable since no specific exemption is provided

Capital Gains – capital gains, Income from other sources are exempt for AIF irrespective of their registration location. However, the same is taxable in the hands of investors.

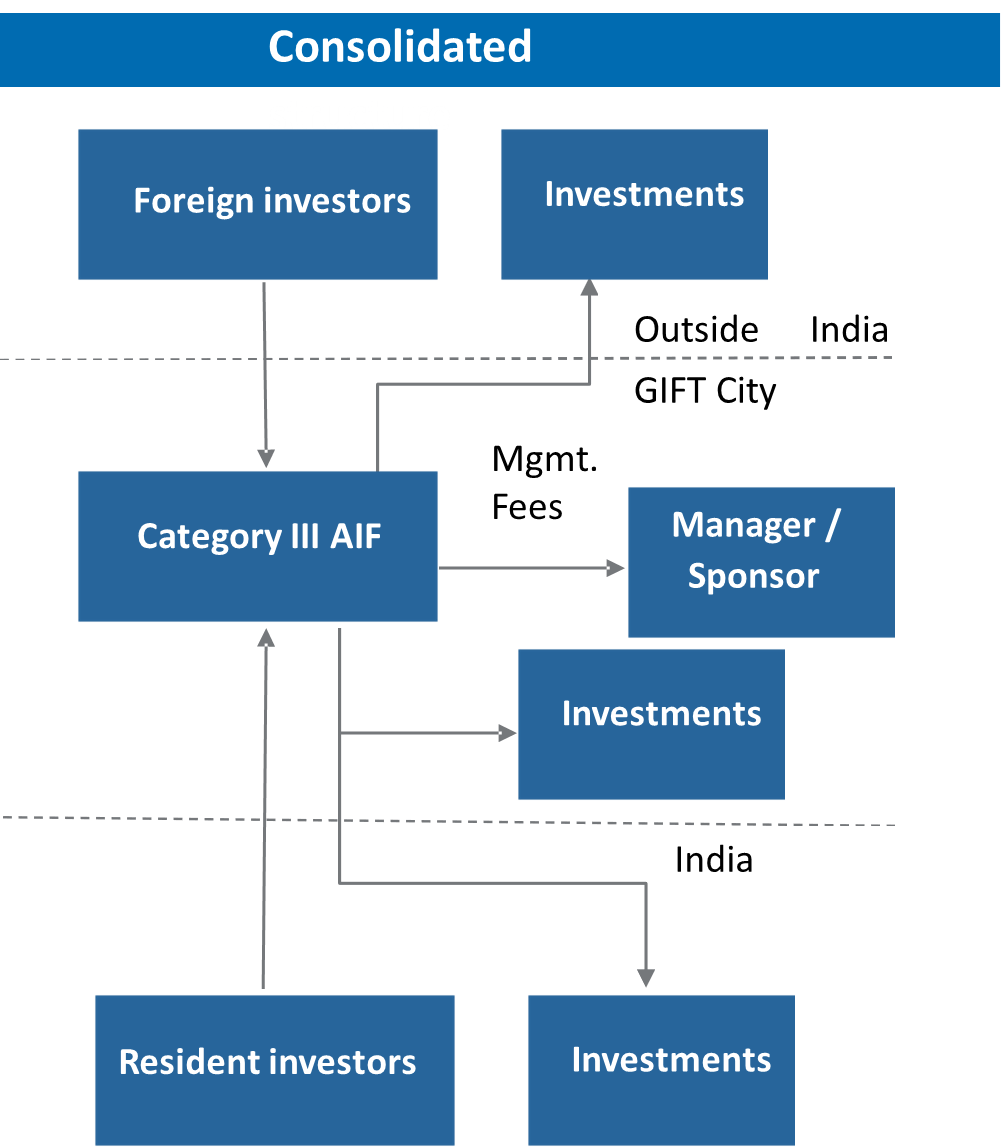

Category III AIF in IFSC

Inbound & Outbound investments

Category III AIF in IFSC

Benefits

By entering the email address you agree to our Privacy Policy.