Due Diligence Report And The Process Of Due Diligence During An M&A

Mergers and Acquisitions (M&A) serve as strategic pathways for businesses aiming to expand operations, strengthen market presence, and achieve growth. However, these transactions carry inherent risks and uncertainties. To address these challenges and make informed decisions, conducting a thorough due diligence process is indispensable.

Due diligence involves an in-depth investigation to evaluate the financial, legal, operational, and commercial dimensions of a target company. The primary goal is to uncover potential risks, liabilities, and opportunities tied to the transaction. Identifying and addressing these factors early on enables businesses to safeguard their interests and make sound strategic choices.

Table of Contents

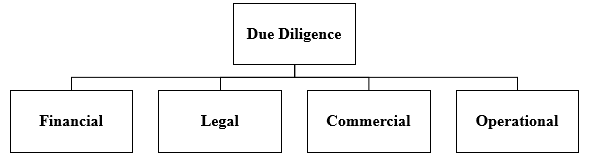

Types of Due Diligence

To conduct a thorough due diligence investigation, it is essential to delve into various aspects of the target company. There are 4 primary types of due diligence:

- Financial Due Diligence: This involves assessing the target company’s financial stability by analyzing financial statements, accounting policies, tax obligations, and any contingent liabilities.

- Legal Due Diligence: This entails a detailed review of the company’s legal documents, intellectual property rights, contracts, and compliance with relevant laws and regulations. It also involves identifying potential legal risks and liabilities.

- Commercial Due Diligence: This focuses on the target’s business model, market position, and customer relationships. The assessment includes analyzing growth potential, competitive positioning, and synergies within the industry.

- Operational Due Diligence: It examines the company’s internal processes, risk management practices, key personnel, and supply chain efficiency. It aims to identify areas for optimization and any operational risks.

The Legal Due Diligence Process

A robust legal due diligence process typically unfolds in the following stages:

- Planning and Scoping: The process begins with defining the scope of the investigation, including areas such as corporate structure, intellectual property, regulatory compliance, contracts, and litigation history. A detailed work plan is formulated, outlining the timeline, responsibilities, and deadlines. An expert team comprising corporate lawyers, intellectual property specialists, and regulatory experts is assembled for the task.

- Data Gathering and Analysis: Legal documents, including incorporation records, bylaws, shareholder agreements, and board resolutions, are reviewed. Intellectual property assets, such as patents and trademarks, are assessed for validity and infringement risks. Contracts with customers, suppliers, and partners are analyzed for obligations, liabilities, and termination clauses. The company’s compliance with applicable laws, including environmental and labour regulations, is thoroughly evaluated. Pending or potential legal disputes are also scrutinized.

- On-Site Visits and Interviews: When necessary, on-site visits are conducted to inspect physical assets such as facilities and equipment. Interviews with key personnel, including compliance officers and senior management, provide additional insights into legal risks, internal controls, and regulatory adherence.

- Report Preparation and Presentation: The findings are consolidated into a comprehensive report highlighting risks, opportunities, and actionable recommendations. The report typically covers the company’s legal structure, intellectual property, regulatory compliance, contracts, and litigation history. It is presented to the management and board of directors, emphasizing key implications for the transaction.

Key Considerations and Final Thoughts

Due diligence is a pivotal component of the M&A process, enabling businesses to identify risks, seize opportunities, and make well-informed decisions. In India, where regulatory landscapes are intricate and culturally nuanced, rigorous due diligence is essential for successful M&A outcomes.

Key considerations include engaging seasoned advisors, conducting exhaustive investigations, respecting cultural sensitivities, and ensuring data privacy and security. India’s unique challenges — such as complex legal frameworks, language barriers, and stringent data protection laws — necessitate meticulous planning. By addressing these challenges proactively, businesses can navigate risks effectively and unlock the full potential of M&A transactions in the region.

King Stubb & Kasiva,

Advocates & Attorneys

New Delhi | Mumbai | Bangalore | Chennai | Hyderabad | Mangalore | Pune | Kochi

Tel: +91 11 41032969 | Email: info@ksandk.com

By entering the email address you agree to our Privacy Policy.