Estate Planning 101: How To Prepare For The Future

Understanding Traditional Wills, Living Wills, Personal Laws & Personal Succession Planning

Introduction

Effective estate planning is an essential legal practice that ensures the orderly management and distribution of one’s assets and healthcare decisions in accordance with personal wishes. Through this session we offer a thorough analysis of three fundamental components of estate planning: traditional wills, living wills, and personal succession planning. Each component plays a distinct role in the legal framework of estate management and is crucial for a comprehensive estate plan. Your estate encompasses Real Estate, Financial Accounts, Investments, Personal Property, Insurance Policies, Intellectual Property, Business Interests, Digital Assets, and Memberships.

Table of Contents

Understanding Your Estate

Understanding and assessing your estate is a critical first step in effective estate planning. This involves a comprehensive evaluation of all your assets, including real property, investments, bank accounts, insurance policies, and any other personal or financial holdings. Each asset may have distinct legal and tax implications that need to be considered when determining its proper disposition within your estate plan, as well as how it will be distributed upon your death.

In addition to evaluating your assets, it is equally important to identify and acknowledge any outstanding debts or liabilities. These liabilities can reduce the net value of your estate and may limit the amount available for distribution to your beneficiaries. Addressing and settling these liabilities during your lifetime can help mitigate their impact on the estate and ensure a smoother administration process.

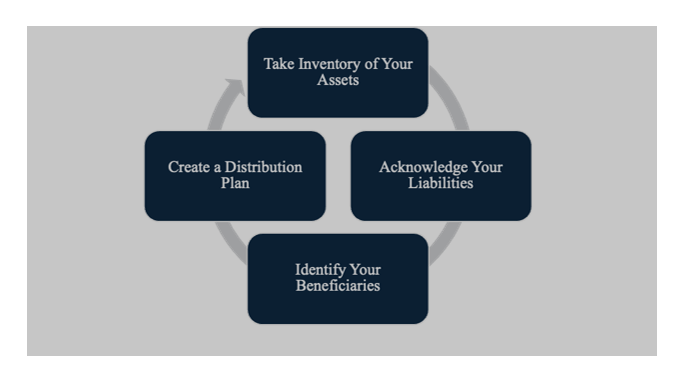

Another essential aspect of estate planning is the determination of beneficiaries, individuals or entities who will inherit your assets. Beneficiaries may include family members, friends, charitable organizations, or other individuals or entities of your choosing. When selecting beneficiaries, you should carefully consider factors such as their financial needs, your personal relationship with them, and your overall objectives for how your estate should be managed and distributed. Legal considerations, including the beneficiaries’ rights and the potential tax consequences for both the estate and the recipients, should also be taken into account to ensure compliance with relevant laws and the fulfillment of your wishes. The process can be summarized in the following manner:

Key Documentation

An effective estate plan usually includes several key documents that outline your wishes and guide the management of your assets after your death. These documents include the following:

1. Will

- The expression “Will” is defined in Section 2(h) of the Indian Succession as “Will means the legal declaration of the intention of the Testator with respect to his property which he desires to be carried into effect after his death”. A Will, also known as a testament, that delineates how an individual’s property, including real estate, personal assets, and financial assets, will be distributed after their death.

- Governing Law: In India, the creation, execution, and administration of wills are governed primarily by the Indian Succession Act, 1925. This Act provides a comprehensive framework for the succession and distribution of estates.

a. Types of Wills Recognized Under Indian Law:

- Joint Wills: A single document created by multiple individuals, typically spouses, outlining the distribution of their assets after death. It specifies beneficiaries and the manner of distribution.

- Mutual Wills: Wills made by two individuals, often spouses, where both agree to dispose of their property in a specific manner. Also known as “mirror wills.”

- Conditional Wills: A Will that takes effect only if certain specified conditions are met. The validity of the Will depends on the occurrence or non-occurrence of these conditions.

- Privileged Wills: Wills made by soldiers, airmen, or sailors while in actual service, allowing them certain relaxations in the formal requirements of a Will.

- Living Wills: A Living Will is a legal document that outlines a person’s medical treatment preferences, including end-of-life care, in case they become unable to communicate their wishes. It ensures that healthcare decisions reflect the individual’s desires during critical situations.

b. Special Considerations

Hindu Succession Act, 1956:

For Hindus, while the Indian Succession Act, 1925, applies generally, the Hindu Succession Act, 1956, also impacts succession, particularly for intestate succession among Hindus. It addresses the distribution of property among legal heirs and the rights of women in inheritance.

Muslim Personal Law

For Muslims, the laws of succession are governed by Islamic principles and Sharia law. These principles are applicable to both wills and intestate succession.

Legal Limitation: A Muslim can legally bequeath only one-third of his estate through a will. This means that the will can allocate up to one-third of the estate to any individual or entity. The remaining two-thirds must be distributed among the legal heirs as per Islamic law.

Execution: The will must be executed according to the principles of Sharia and the provisions of Indian law. It should be drafted and signed by the testator and witnessed according to legal requirements.

In the case where a Muslim marries a Hindu and the marriage is registered under the Special Marriage Act, 1954, the will of the Muslim spouse should adhere to the provisions of the Indian Succession Act, 1925. This approach ensures consistency in the legal treatment of the estate and aligns with the marriage’s legal framework.

Interfaith Marriages

For individuals who register under the Special Marriage Act, 1954, their estate planning and distribution are governed by the Indian Succession Act, 1925, regardless of their personal religious laws. This Act provides a neutral framework for succession and is generally applicable to interfaith couples who marry under this Act. The Indian Succession Act, 1925, applies to both parties regardless of their religious background. Section 21 of the Indian Succession Act, 1925

Section 21 Special Marriage Act, 1954: This section provides that the provisions of the Indian Succession Act, 1925 shall apply to the wills and estates of persons married under the Special Marriage Act, 1954.

Personal Laws: For ancestral property, personal laws of the individual’s religion often govern succession. This means that even if an interfaith couple is married under the Special Marriage Act, claims to ancestral property may still be subject to personal laws (like Hindu Law for Hindus, Muslim Law for Muslims, etc.).

Indian Succession Act, 1925: This Act governs the succession of property under the Special Marriage Act but primarily applies to properties acquired or owned by individuals rather than ancestral property.

2. Powers of Attorney: Designate individuals to handle financial and legal matters if incapacitated. This includes durable powers of attorney for financial matters and healthcare powers of attorney for medical decisions. A durable power of attorney remains effective even if the principal becomes incapacitated. In India, this durability is typically implied if the POA is executed with the proper formalities and intended to continue despite the principal’s incapacitation.

3. Special Power of Attorney (SPA): in the event the Testator want a appoint a designated person to act on behalf of the principal for specific purpose, an SPA may be executed. Unlike a General Power of Attorney, which provides broad authority, an SPA is limited to particular matters, such as managing a particular property transaction, handling specific legal cases, or conducting certain financial activities. In estate planning, an SPA is crucial when the principal wants to ensure that a trusted individual can execute specific duties without granting full control over all their affairs. This precision helps maintain the principal’s autonomy while ensuring that important matters are addressed efficiently.

4. Trust: A Trust is a legal arrangement wherein the Settlor (the individual creating the trust) transfers ownership of their assets to a Trustee, who is responsible for managing, safeguarding, and distributing those assets for the benefit of designated beneficiaries, as per the terms and conditions outlined in the Trust Deed. This legal mechanism allows the Settlor to ensure the efficient management and transfer of assets during their lifetime or after their passing.

A trust provides significant advantages, such as asset protection, efficient tax planning, and probate avoidance, which helps to minimize delays and legal costs associated with estate settlement. Moreover, it offers a higher level of privacy, as the trust and its contents are generally not subject to public scrutiny, unlike wills which are typically filed in probate court.

5. Tax Implications

Estate planning in India requires careful attention to various tax factors that can impact the value of your estate and the inheritance your beneficiaries receive. These include the following:

- Gift Tax: While India does not have a specific gift tax, certain gifts may be subject to capital gains tax or other taxes, depending on the type of asset and the relationship between the giver and the recipient.

- Inheritance Tax: India does not impose an inheritance tax (or estate duty). However, if inherited assets have increased in value, capital gains tax may apply when they are sold.

- Capital Gains Tax: This tax applies to the profit made from selling or transferring capital assets. For assets passed down after death, their fair market value at the time of death is usually considered the cost for the beneficiaries. Any gain in value from the original acquisition to the time of death could be subject to capital gains tax.

Conclusion

Understanding the distinctions and applications of traditional wills, living wills, and personal succession planning is pivotal for effective estate management. Traditional wills delineate the distribution of assets retrospectively, providing a clear framework for the allocation of estate resources. Living wills, or advance directives, articulate an individual’s healthcare preferences in scenarios of incapacity, ensuring that medical decisions align with their wishes. Personal succession planning, on the other hand, encompasses a comprehensive strategy that integrates these elements, alongside trusts and other mechanisms, to facilitate the efficient management and distribution of an estate.

By consolidating these components into a unified estate plan, individuals can not only ensure their intentions are executed precisely but also enhance the efficiency of asset management and provide for their loved ones in a structured manner. The absence of a well-structured estate plan often results in legal complexities and protracted proceedings, underscoring the importance of proactive estate planning. The failure to recognize the critical role of wills and succession planning can lead to unnecessary complications and disputes following an individual’s demise, which can be mitigated through careful and informed planning.

King Stubb & Kasiva,

Advocates & Attorneys

New Delhi | Mumbai | Bangalore | Chennai | Hyderabad | Mangalore | Pune | Kochi

Tel: +91 11 41032969 | Email: info@ksandk.com

By entering the email address you agree to our Privacy Policy.