Legal And Tax Considerations In PE/VC Exits In India

This is the big moment – after years of planning and risk-taking, you either make a ton of money or you don’t. Whether you are selling your shares on the stock market (IPO), selling the whole company to another company, or selling your shares to another investor, you have got to deal with a lot of legal and tax stuff. It’s not just about closing the deal; it’s about making sure you get as much money as possible, while doing everything by the book.

Table of Contents

How can you cash out? (Exit Mechanisms)

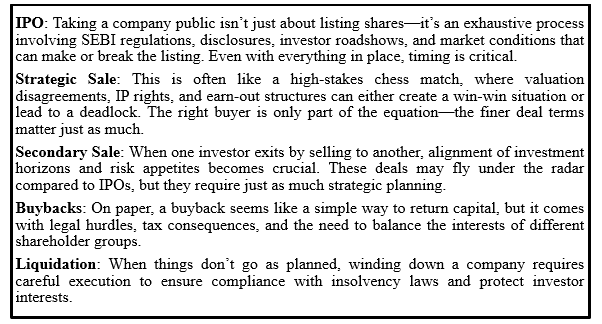

Exits can take several forms:

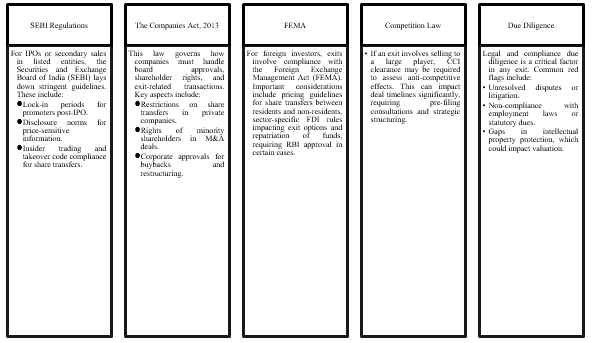

Legal Framework

The Tax Game

This is where smart planning really pays off. Some important things to take care of are as follows:

- You have to figure out how much tax you’ll pay on your profits, and it depends on how long you held the investment.

- Even small taxes like stamp duty can add up.

- There are ways to structure your deal for tax savings.

- If your investors are from other countries, you have to deal with withholding taxes and tax treaties. Thus, understanding those tax treaties (DTAAs) is crucial.

Conclusion

To pull off a successful exit in India, you need more than just a good buyer and good timing. You need to understand all the legal, regulatory, and tax requirements, and you have to plan early, be flexible, and get expert help. In India, those who are prepared will always have the advantage.

King Stubb & Kasiva,

Advocates & Attorneys

New Delhi | Mumbai | Bangalore | Chennai | Hyderabad | Mangalore | Pune | Kochi

Tel: +91 11 41032969 | Email: info@ksandk.com

By entering the email address you agree to our Privacy Policy.