Decoding The New Labour Code By Answering 8 FAQs

The New Labour Code

States across the country are currently engaged in implementing the new updated labour policies that have been approved by the Central Government. The following addresses some questions employers and employees have in terms of how the new codes will affect them, major changes, drawbacks and how businesses will be affected.

Q1: What are the labour codes?

The labour codes are a codification of the existing labour laws with suitable amendments legislated by Parliament. This has been considered the most major labour reform in recent years whereby 29 erstwhile labour legislations are amalgamated into four comprehensive labour codes namely (“Labour Codes”):

- The Code on Wages, 2019 has subsumed the Payment of Wages Act, 1936, Minimum Wages Act, 1948, Payment of Bonus Act, 1965 and Equal Remuneration Act, 1976.

- The Code on Social Security, 2020 has subsumed the Employee’s Compensation Act 1923, Employees’ State Insurance Act 1948, Employees’ Provident Funds and Miscellaneous Provisions Act 1952, Employment Exchanges (Compulsory Notification of Vacancies) Act 1959, Maternity Benefit Act 1961, Payment of Gratuity Act 1972 and the Cine-Workers Welfare Fund Act 1981.

- The Occupational Safety, Health and Working Conditions Code, 2020 has subsumed the Factories Act 1948, Contract Labor (Regulation and Abolition) Act 1970, Mines Act 1952, Dock Workers (Safety, Health and Welfare) Act 1986, Building & Other Construction Workers (Regulation of Employment and Conditions of Service) Act 1996, Plantations Labor Act 1951, Inter-State Migrant Workmen (Regulation of Employment and Conditions of Service) Act 1979, Working Journalist and Other Newspaper Employees (Conditions of Service and Miscellaneous Provision) Act 1955, Working Journalist (Fixation of rates of wages) Act 1958, Cine Workers and Cinema Theatre Workers Act 1981, Motor Transport Workers Act 1961, Sales Promotion Employees (Conditions of Service) Act 1976 and the Beedi and Cigar Workers (Conditions of Employment) Act 1966.

- The Industrial Relations Code, 2020 has subsumed the Trade Unions Act 1926, Industrial Employment (Standing Orders) Act 1946 and Industrial Disputes Act, 1947.

Q2: What is the need for the updated labour codes?

There has been a pressing need to update the provisions of the codes since many aspects of the labour laws trace their origin to the era of the British Raj. However, with changing times, many of them have been rendered moot or have no contemporary relevance. Rather than protecting the interests of workers, these provisions became difficult for them. The outdated web of legislation was so dense that workers had to fill in four forms to claim a single benefit. The present government has thus repealed these laws; 29 Labour Laws have been codified into 4 Labour Codes.

The Second National Commission of Labour, which submitted its report in 2002, highlighted the multiplicity of labour laws in India and recommended that they be codified into a few cohesive ones that function at a central level. While discussions were held on it, however, no serious initiative was taken in this direction during the time period from 2004 to 2014.

From 2015 to 2019, the Ministry of Labour and Employment organized 9 tripartite discussions in which Central Trade Unions, Employers’ Associations and representatives of state governments were invited to give their opinions/suggestions on labour reforms. All four Bills were also examined by the Parliamentary Standing Committee which gave its recommendations to the Centre [1].

Q3: What are the benefits of the labour codes?

The labour codes help in simplifying compliance by ensuring a single licensing mechanism for industries. Previously, the industries were required to apply for licenses under different laws. The introduction of technology in creating national databases has ensured workforce formalization, which is a primary step toward providing welfare benefits. Furthermore, the ambit of workmen/employees has been widened to cover all those who were previously not offered coverage under the labour laws.

Uniform definitions for wages are provided such that there is no confusion in its interpretation. The statutory benefits offer more coverage that includes informal workers. Also, the ease of doing business and faster dispute resolution mechanism is beneficial to the businesses. The usage of technology for efficacious implementation and ease of compliance is a positive step envisaged by the labour codes.

Q4: What are the substantial changes brought about by the labour codes?

Code on Wages, 2019

- Coverage now includes both organized as well as unorganized sectors, including persons in managerial, supervisory, administrative and operational.

- Minimum wages are mandated to be reviewed every 5 years to ensure that the wages are updated with changing economic scenarios.

- Wages disparity due to gender is done away with; there are updated provisions for paying equal wages to men and women.

- The concept of floor wages is newly introduced whereby the regional wage disparity is effectively tackled.

- The wage ceiling has been increased and timely payment of wages is to be ensured.

- Under this code, the inspector regime is replaced with inspector-cum-facilitator role whereby they would be entrusted with being a facilitator as well as an inspector to assist the employer in overcoming any non-compliances before instituting legal proceedings.

- The definition of wages has also been made uniform and standard.

Code on Social Security, 2020

- Indian regulations are aimed at providing various social securities such as insurance, pension, gratuity, maternity benefit etc. The Employees’ State Insurance Scheme (ESIC) is now ensured for all workers including unorganized workers and has been made applicable pan-India i.e., in all districts of the country and for all establishments employing 10 or more employees.

- The scope and ambit of ESIC has been broadened considerably to include new-age platform and gig workers as well as plantation workers.

- Institutions working in hazardous areas must be compulsorily registered with ESIC. Even if a single worker is engaged in hazardous work, they must be offered ESIC benefits.

- The pension scheme Employees’ Provident Fund Organisation (EPFO) has been extended to all workers of organized, unorganized and self-employed sectors.

- The distinction between fixed-term and permanent employees has been eliminated so that both types of workers receive the same social benefits. The minimum service requirement has also been removed for payment of gratuity in the case of fixed-term employees and is now based on a proportionate benefit of service. This makes it more inclusive.

- Internet technology is being used to ensure efficiency in the creation of a national database of workers of the unorganized sector through registration via a portal using an Aadhaar-based Universal Account Number (UAN) for ESIC, EPFO and the unorganised sector of workers to ensure seamless portability.

Occupational Safety, Health and Working Conditions Code, 2020

- This Code seeks to cover the interests of workers engaged in factories, mines, plantations, the motor transport sector, bidi and cigar workers, and contract and migrant workers.

- For interstate migrant workers, a national database has been created through which they can obtain a One Nation One Ration card for ensuring social security benefits for themselves and family residing in different states.

- A cess fund has also been created for building/construction workers who frequently migrate to different states for work.

- The issuance of appointment letters is now mandatory in the code.

- Employers are also mandated to provide free annual health check-ups to workers.

- Moreover, the Code includes provisions for the employment of women between 7 PM to 6 AM with conditions related to their consent and safety, working hours, and holidays.

Industrial Relations Code, 2020

- The threshold limit for the applicability of standing orders has been raised from 100 workers to 300 workers.

- Every establishment having 20 or more workers is mandated to set up a Grievance Redressal Committee.

- The Code also proposes the setting up of a ‘Reskilling Fund’ for retrenched employees.

- There are timelines provided for strikes and lockouts concerning the notice and its validity.

- In industrial establishments, a trade union having 51% votes shall be recognised as the sole negotiating union which can make agreements with employers. However, in industrial establishments in which no trade union gets 51 % votes, a negotiating council of trade unions shall be constituted for making agreements with the employer.

- The Code also states that no person employed in an industrial establishment shall go on a strike without a 60-day notice period.

Q5: What are the drawbacks of the labour codes?

Concerning the Industrial Relations Code, 2020, employers would have more power to hire and fire employees as the threshold limit for applicability of standing orders has been increased to 300 from 100 workers. The imposition of arbitrary service conditions due to the flexibility provided to the employers is also a real threat. Under this Code, the government is also empowered to increase (but not decrease) the threshold for establishments to seek prior permission before closure, lay-off or retrenchment. This provides undue advantages to businesses vis-à-vis the workers.

The Code on Social Security, 2020, which boasts of providing universal coverage to all workers, leaves out all establishments employing fewer than 10 workers, excluding a large chunk of informal workers and enterprises. There is a clear exclusion of construction workers deployed at the level of private households, domestic workers, sanitation workers, self-employed workers like street vendors, scheme workers like the ASHA and anganwadi workers and so on [2]. Moreover, the definitions in the Code on Social Security, 2020 are still vague and unclear as to whether the gig and platform workers are considered unorganized workers or otherwise.

Further, a careful analysis that references Section 96(1) and (2) of Industrial Relations Code, 2020 and Section 127 (1) and (2) of the Occupational Safety, Health and Working Conditions Code, 2020 reveals excessive delegations to the appropriate government, allowing them wide exemption powers from the provisions of the said Code relating to hours of work, safety standards, retrenchment process, collective bargaining rights, contractual labour etc. This might end up defeating the very purpose of the Codes.

Lastly, as compliance is primarily based on employee thresholds for the applicability of the new provisions, businesses might be encouraged to remain small-scale to avoid statutory compliances.

Q6: How should businesses gear up for these changes?

The cost or expenses to the businesses might increase due to the pro-labour reforms resulting from higher gratuity payouts. Suitable measures must be taken to account for these. The human resource policy of the organization would also require changes to conform to the updated laws regarding payment of salary, tracking overtime and additional safety provisions for women.

In addition to this, businesses would need to bring about an attitudinal shift towards the workers so that the transition as per the new Labour Codes is smooth and efficient. The compliance aspect will also need to undergo changes based on the final rules and state amendments. It is important to remember that the success of any business depends on the ultimate welfare of the workers involved.

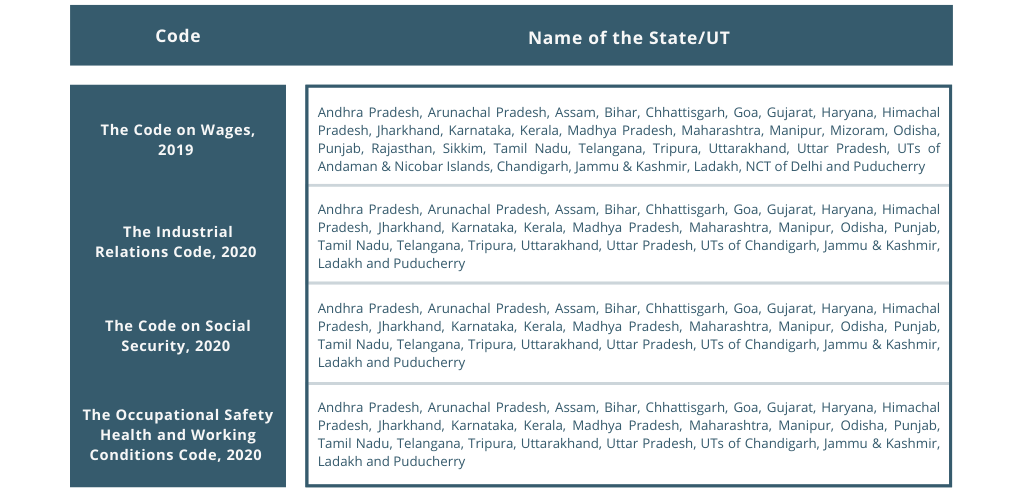

Q7: What is the current status of implementation?

It is pertinent to note that the ‘Labour’ is a concurrent list subject in the Constitution of India. Based on the latest data available, the following is a short breakup of the State/Union Territories (UTs) which have pre-published the draft rules, inviting comments from all stakeholders [3].

Although there has been steady progress in the aspect of implementation, there are no specific details as to the exact effective date for enforcement.

Q8. What is the impact of the codes on the working hours of the employees? Would 4 day work week be practical?

It is pertinent to note that the Occupational Safety, Health and Working Conditions Code, 2020 deals with the conditions of working that regulate working hours and working days for any establishment. It states that no worker is allowed to work more than 8 hours a day and more than 48 hours per week. However, if the workman exceeds 8 hours per day subject to a maximum of 12 hours a day (including intervals for rest), then they must be provided overtime wages in accordance with this Code.

This implies that a 4-day work week will not be practically feasible until and unless overtime wages are paid. The overtime hours would also be subject to a total number of hours of overtime as fixed by the appropriate government. For instance, if overtime hours are fixed at 21 hours per quarter, this implies that only 7 overtime hours per month would be possible, in which case a 4-day work week would not be practical due to this limitation.

Moreover, as per Section 27 of the Code, workmen shall be paid twice the rate of wages for overtime work. This would increase the cost to the establishment unless it voluntarily decides to reduce the number of hours per week and ensure a 4-day work week.

Wrapping Up

It is suggested that the government continues to roll out the codes in a phased manner, allowing businesses ample time to adjust to the new dynamics of labour laws. Much like the consultation with the states prior to GST implementation, it is suggested that the central government regularly holds talks and workshops with states to ensure seamless implementation of the new labour laws in their respective states.

Lastly, a legal analysis of the labour codes reveals that the government’s decision to codify the laws and update them to keep afoot with changing times has been a positive development. However, it is to be seen how the states will notify the rules for their enforcement in regional jurisdictions.

- [1] Ministry of Labour and Employment, Booklet-New Labour Code for New India

- [2] https://thewire.in/labour/new-labour-codes-after-rushing-them-through-parliament-why-is-the-govt-delaying-implementation

- [3] Ministry Of Labour And Employment, Lok Sabha Unstarred Question No. 22 to be answered on 18.07.2022, regarding the implementation of Labour Codes

Contributed by Aurelia Menezes, Partner & Abhilasha SG, Associate

By entering the email address you agree to our Privacy Policy.