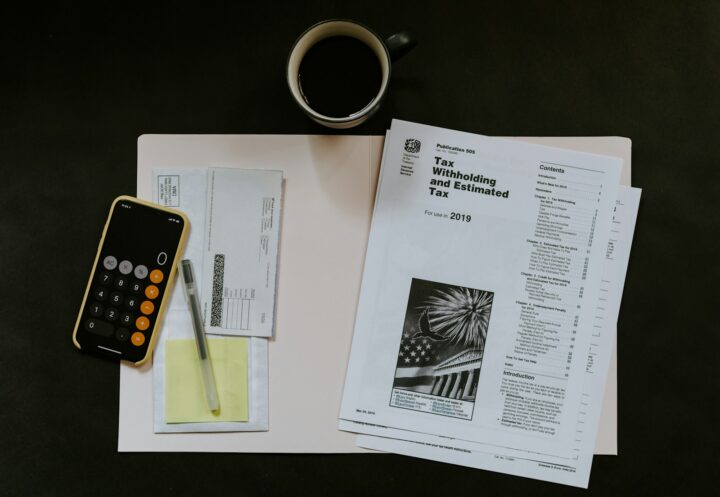

Tax

Taxation Legal Services in India

A state needs money to manage its finances and administer its government. Therefore, the government levies several types of taxes on the income of both individuals and corporations. In India, the Central Government and the State Governments each have their taxing authority. The local governments, including the Municipality and the Local Governments, also levy a few small taxes. Taxes may be broadly categorized into two groups: direct taxes and indirect taxes.

A tax that is paid directly to the institution that is imposing it by an individual or an organization is known as a direct tax (generally government). The phrase “indirect tax” has several different meanings. In the common meaning, an indirect tax is collected from the person who will ultimately suffer the economic burden of the tax through an intermediary (such as a retail store), such as sales tax, a particular tax, value-added tax (VAT), or goods and services tax (GST) (such as the consumer).

Our Services

At KSK, our team of tax attorneys advises on all aspects of tax requirements for companies in the following areas:

- International taxation

- Corporate taxation

- Transfer pricing

- Expatriate taxation

- Customs

- GST

- Excise duty

- VAT and CST

Through services like as an expert Tax Law Firm in India:

- Transactional structuring

- Compliance management solutions

- Validation of tax computation

- Tax litigation

- Contractual negotiation

Key Highlights

- Comprehensive Expertise: Our team of tax experts at KSK provides comprehensive guidance on various tax aspects for companies, ensuring a thorough understanding of both national and international tax regulations.

- End-to-End Services:

- Transactional Structuring: Crafting tax-efficient structures for transactions to optimize financial outcomes.

- Compliance Management Solutions: Proactive solutions to ensure adherence to tax regulations and minimize risks.

- Validation of Tax Computation: Rigorous examination and validation of tax computations for accuracy and compliance.

- Tax Litigation: Skilled representation in tax-related disputes, ensuring your interests are protected.

- Client-Centric Approach: Our focus is on understanding the unique needs of each client, providing tailored solutions that align with their business goals while ensuring compliance with tax laws.

Approach at KSK

The income tax and international tax systems in India are complicated. Managing the tax function in most organizations may be difficult since the legislation is continually changing to reflect the government’s current policies and because the tax department is tenacious and tends to litigate most disputes. The business climate is evolving, and tax assessments and compliances, which are increasingly a cornerstone of businesses, need continual monitoring and assistance. To help companies and individuals, KSK adopts a multidisciplinary approach.

Our tax team is comprised of veteran lawyers, accountants, economists, and technologists to combine the expertise of different domains. They regularly work with the other practice groups such as M&A, Private Equity and Fund Practice Group, Litigation Practice Group, Infrastructure, and Project Finance Group to have a comprehensive understanding of issues and deliver efficient legal solutions.

Insights

Key Professionals

Related Practice Areas

FAQs

Why do businesses need professional tax legal services?

Professional tax legal services help businesses navigate complex tax regulations, ensuring compliance and optimizing financial outcomes. It’s crucial for minimizing risks, taking advantage of tax benefits, and staying abreast of ever-changing tax laws.

What is the significance of international taxation for businesses?

International taxation addresses the complexities of cross-border transactions, helping businesses structure their operations to comply with diverse tax laws, avoid double taxation, and maximize global opportunities.

How does a Tax Law Firm assist with transfer pricing?

Transfer pricing involves setting prices for transactions between affiliated companies. Our Tax Law Firm helps businesses establish and manage these prices to comply with regulations, optimize tax efficiency, and minimize risks of audits.

What sets KSK apart in the field of tax legal services?

KSK distinguishes itself through a client-centric approach, diverse specializations, up-to-date knowledge of tax laws, and a proactive stance on risk management. Our focus is on providing tailored solutions that align with each client’s unique business goals.