Across Borders and Beyond: Understanding NRI Income Tax Obligations

Introduction

As the world grows more interconnected, an increasing number of Indians are departing from their homeland in search of new possibilities. Non-Resident Indians (NRIs) make major contributions to the global economy while remaining deeply connected to their Indian heritage. Regardless of how exciting their overseas pursuits are, NRIs must be conscious of their domestic income tax duties. Tax regulations in India differ depending on a person’s residency status. Regardless of where they live, NRIs are subject to special restrictions governing their income tax duties.

NRIs can receive an understanding of their income tax obligations and make sound financial decisions by shedding light on these topics. It is important to remember, however, that tax regulations can change and that individual circumstances can vary. NRIs should always consult with tax professionals or financial consultants to guarantee compliance with the most recent rules and to receive tailored guidance.

This article aims to elaborate on the requirements of taxation for NRIs in the following manner:

- Determining Residential Status

- Taxable Income for NRIs

- Exemptions and Deductions

- Avoiding Double Taxation

- Tax Filing and Compliance

- Recent Developments

Table of Contents

Determining Residential Status

To determine the residential status of a person, the conditions under Section 6 of the Income Tax Act must be considered:

- A person is designated a non-resident Indian if he or she is an Indian citizen or a person of Indian descent but does not reside in India. The individual’s residency plays a crucial role in determining their income tax obligations.

- A person is considered to be a resident of India for a particular fiscal year if any of the following conditions are met:

- Stay in India for at least 182 days in the previous year, or

- Stay in India for at least 60 days in the last year and 365 days in the four years before the last year.

- There are exceptions for Indian citizens and Persons of Indian Origin (PIOs). The above-mentioned 60-day requirement is replaced with 182 days for Indian citizens and people of Indian descent who visit India during the year. Similarly, if an Indian citizen left India for employment or as a crew member in any previous year, the 60-day requirement is replaced with 182 days.

Amendments to the 2020 Finance Act

- The 60-day requirement is replaced with 120 days for Indian citizens and persons of Indian origin whose total income (excluding income from foreign sources) exceeded Rs. 15 lakhs in the previous year. Except for income derived from a business controlled in or a profession established in India, income from foreign sources refers to money earned outside India.

- The Finance Act of 2020 introduced a new provision, section 6(1A), which states that an Indian citizen will be deemed to be a resident in India only if their total income (excluding income from foreign sources) for the preceding year exceeds Rs. 15 lakhs. Nonetheless, this provision only applies if the individual is not subject to taxation in any country due to domicile, residence, or other comparable criteria.

Indian Origin Criteria

- An individual is considered of Indian descent if they or one of their parents/grandparents were born in undivided India.

Taxable Income for NRIs

Income from Salary

It is taxable in India if an NRI receives a salary in India directly into their Indian bank account or earned salary in India for services rendered. The same income tax bracket rates apply to non-residents as to residents.

Income from House Property

- NRIs are taxed on rental income or income from a vacant property located in India.

- Claimable deductions include the standard deduction, municipal taxes, mortgage interest, and principal repayment.

- Income is subject to tax regardless of whether it is received in an account outside India or in an NRE account.

Business and Profession Income

An NRI’s income from a business established and managed in India is taxable. The same income tax bracket rates apply to non-residents as to residents.

Income from Other Sources

NRIs are subject to tax on interest earned on fixed deposits and savings accounts. The interest garnered on NRE and FCNR accounts is exempt from taxation, whereas the interest earned on NRO accounts is fully taxable.

Income from Capital Gains

- Gains on the sale of capital assets located in India are taxable for non-resident Indians.

- TDS rates on the sale of residential real estate are 20% for long-term gains and 30% for short-term gains.

Exemptions And Deductions

Exemptions

- Interest earned on NRE/FCNR accounts.

- Interest earned on government savings certificates and notified bonds.

- Dividends earned from shares of domestic Indian companies.

- Long-term capital gains from listed equity shares and equity-oriented mutual funds.

- Capital gains exemptions under sections:

- Section 54: Exemption on sale of a house property if proceeds are used to purchase another property or deposited in a Capital Gains Account Scheme.

- Section 54F: Exemption on sale of any property other than a house, if proceeds are used to construct or purchase a new house.

- Section 54EC: Exemption on long-term capital gains if invested in specified bonds.

Deductions

- Section 80C:

- Life insurance premium payments.Tuition fee payments for the education of up to 2 children.Principal repayment on a loan for house property.

- Investment in Unit Linked Insurance Plans (ULIPs), Equity-linked Saving Schemes (ELSS), National Saving Certificate (NSC), etc.

- Section 80D:

- Premiums for health insurance of immediate family and dependents.

- Deduction for preventive health check-ups.

- Section 80E:

- Deduction of interest paid on an education loan.

- Section 80G:

- Donations made as per Section 80G of the Income Tax Act.

- Section 80TTA:

- Deductions on interest earned on savings bank accounts.

- Exemption on long-term capital gains by reinvesting in another house property or specific bonds.

There are specific deduction limits for all categories of deductions.

Avoiding Double Taxation

When an individual is required to pay taxes on the same income in two distinct countries, this is known as double taxation. This can be a major concern for NRIs who earn income in both their home country and India, where they may hold citizenship or own revenue-generating assets.

India has entered into Double Tax Avoidance Agreements (DTAAs) with numerous countries to address this issue. The purpose of DTAA is to provide relief from double taxation for non-resident Indians by allocating taxing rights and providing mechanisms to avoid or reduce tax obligations in both countries.

Specific rules are established under the DTAA to determine which country has the primary authority to tax certain categories of income. Typically, the agreement encompasses various forms of income, such as salary, dividends, interest, royalties, and capital gains.

Key DTAA characteristics include:

- Tax Residency

- Prevention of Double Taxation

- Tax Relief Methods

- Elimination of Capital Gains’ Dual Taxation

To receive the benefits of the DTAA, NRIs must comply with the agreement’s requirements and procedures. This typically involves providing the tax authorities in their country of domicile with the required documentation and evidence of taxes paid in India.

Tax Filing and Compliance

An NRI has to follow the following steps for Tax Filing and Compliance:

- Determine residential status based on days of stay in India (182 days or more outside India for NRI status).

- Calculate taxable income, considering various sources and deductions.

- File income tax returns using the appropriate form (ITR-2 or ITR-3) by the specified due date (typically July 31st).[1]

- Pay taxes through online payment or authorized banks, retaining proof of payment.

- Claim deductions and exemptions available under the Income Tax Act (e.g., Section 80C, 80D, 80E).

- Ensure compliance by providing accurate information, disclosing all income sources, and maintaining relevant documents.

- Obtain a Tax Identification Number (TIN) or Permanent Account Number (PAN) if required.

- Consider Double Tax Avoidance Agreements (DTAA) between India and the country of residence to avoid double taxation.

- Verify and validate filed income tax returns within 120 days.

It is advisable to consult a tax expert for specific advice and to keep abreast of the latest Income Tax Department regulations and notifications.

Recent Developments

- Digitization: The Income Tax Department provides online filing, payment, and verification platforms, making the process easier for the taxation of NRIs.

- Increased Scrutiny: Increased scrutiny methods and technology-driven systems ensure tax compliance.

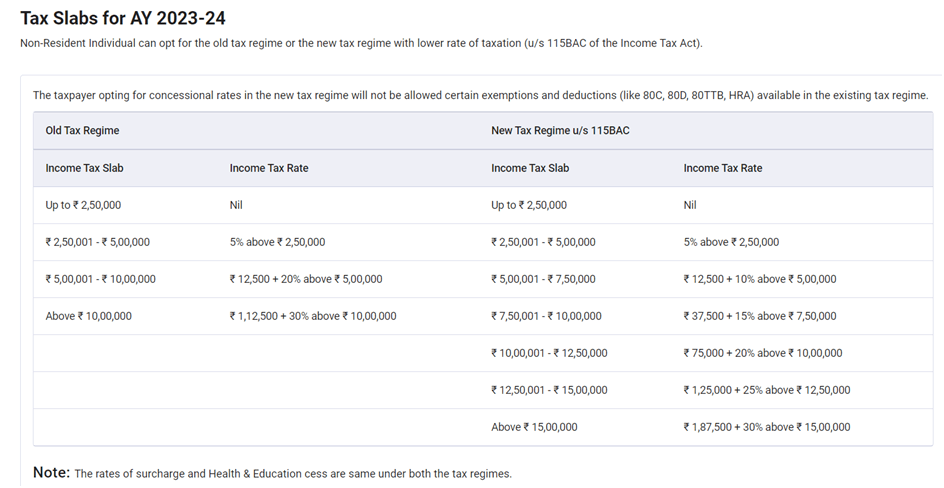

- Revised Tax Rates: Tax rates and brackets for income tax for NRIs are adjusted regularly, so staying current is essential.

Source[2]

- DTAA Amendments: Changes to DTAA have an impact on NRI taxation.

- Enhanced Reporting Requirements: Detailed asset, investment, and foreign income disclosure requirements.

- Cross-Border Financial Information Exchange: International alliances and agreements have increased financial transparency.

- Strict Anti-Avoidance Measures: Preventing tax evasion and aggressive tax planning.

Conclusion

Understanding the taxation rules and compliance requirements for foreigner income tax or taxation of NRIs is critical for efficient financial planning and compliance with tax laws. NRIs must determine their residency status, calculate their taxable income, claim double taxation benefits under the DTAA, and file and comply on time. Digitalization, increased inspection, revised tax rates, and enhanced reporting requirements are recent trends. It is critical to be educated and seek professional guidance while negotiating the complexities of income tax for NRIs and maximizing tax benefits while ensuring compliance.

FAQs

What is the tax residency status for NRIs?

NRIs need to stay outside India for 182 days or more in a financial year to qualify as non-residents for tax purposes.

Can NRIs claim deductions and exemptions on their income?

Yes, NRIs can claim deductions and exemptions available under the Income Tax Act, such as those under Section 80C, 80D, and 80E, similar to resident taxpayers.

u003cstrongu003eHow can NRIs avoid double taxation on their income?u003c/strongu003e

DTAAs between India and their place of residency allow NRIs to avoid paying tax twice on the same income by offering tax credits or lower tax rates.

[1]https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-0.

[2]https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-0.

King Stubb & Kasiva,

Advocates & Attorneys

New Delhi | Mumbai | Bangalore | Chennai | Hyderabad | Mangalore | Pune | Kochi

Tel: +91 11 41032969 | Email: info@ksandk.com

By entering the email address you agree to our Privacy Policy.